Stock buybacks split investors, the media, and politicians. Are they a good thing, or not? The answer is simple but the nuances aren’t. In this article, we’ll wrap up the debate.

Why Companies Buy Back Stock

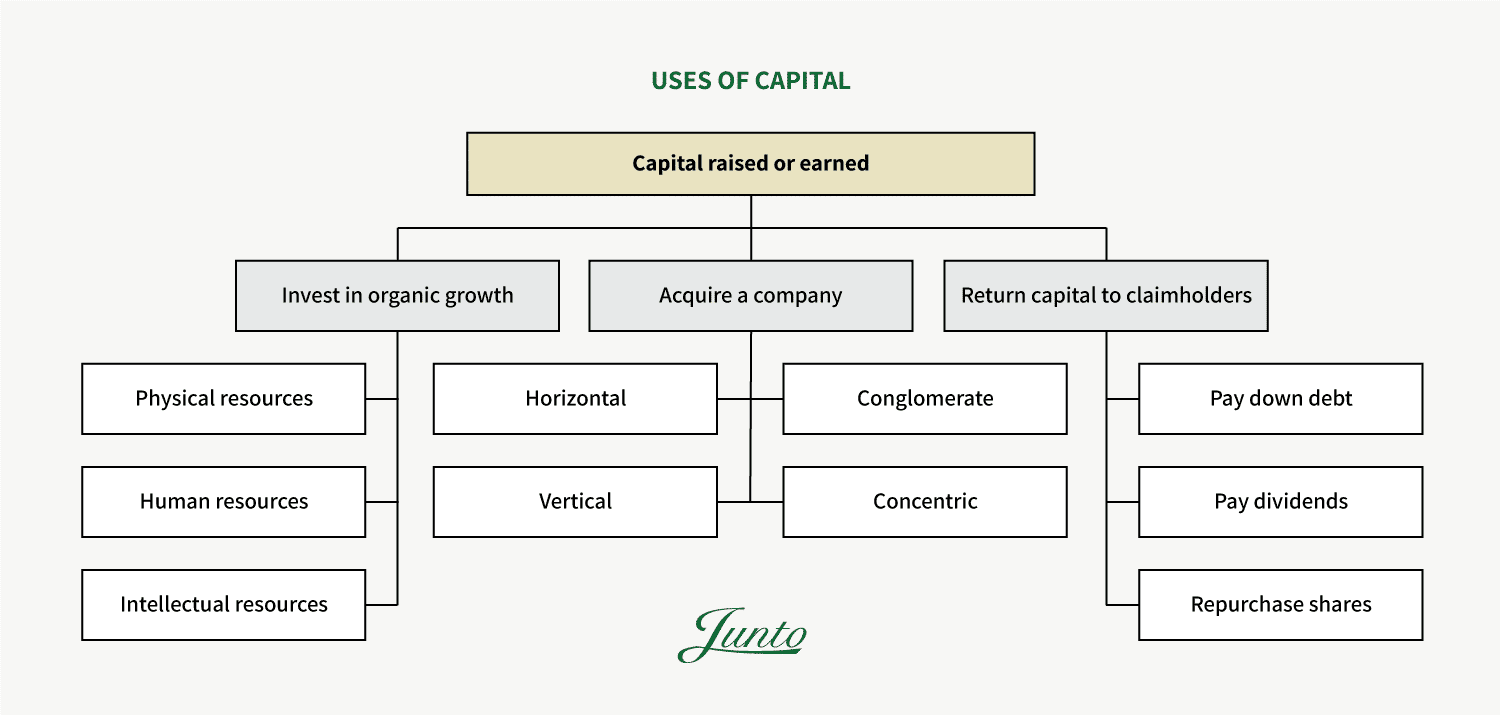

When allocating capital, whether raised or retained through operations, companies have three main choices. They can either invest in organic growth, engage in M&A, or return capital to claimholders by paying down debt, paying out dividends, or buying back stock.

Similar to dividends or paying down debt, stock buybacks (or “repurchases”) are a way to return capital to claimholders. While a dividend is a cash bonus to the shareholder, a buyback takes shares out of the market and increases the continued shareholder’s ownership of the company. The shareholders who elect to sell their stake to the company can happily do so, receiving cash for stock, while the remaining shareholders see their ownership percentage go up while the company cash goes down.

Because buybacks are only one option within the three capital allocation options, it’s dependent on the company’s opportunities in each of the buckets. The bucket to allocate capital to is the one that promises the highest return with the lowest risk of not working out.

So between keeping the cash or returning it to claimholders, how do you know whether management allocates capital to the right bucket? One useful way is to think about Warren Buffett’s $1 test:

We feel noble intentions should be checked periodically against results. We test the wisdom of retaining earnings by assessing whether retention, over time, delivers shareholders at least $1 of market value for each $1 retained.

Unrestricted earnings should be retained only where there is a reasonable prospect—backed preferably by historical evidence or, when appropriate by a thoughtful analysis of the future—that for every dollar retained by the corporation, at least one dollar of market value will be created for owners. This will happen only if the capital retained produces incremental earnings equal to, or above, those generally available to investors.

When Buffett uses the phrase “generally available to investors” he essentially means the opportunity cost of capital. A business only passes the $1 test if it earns a return on its incremental investments in excess of its cost of capital. So if a business is able to deploy its capital and generate an incremental return in excess of its cost of capital, it would avoid using the third option of returning capital to claimholders.

However, that requires an unless. As many strategic actions are based on projections—sometimes stretched far into the future based on arcane budgeting methods—they will to some extent always be risky and uncertain. Sometimes, they’re leaps of faith into the unknown.

And so, there might be a capital allocation option that is much more certain than that: when a company’s own stock is selling far below intrinsic value in the market. When that happens, management has an easy capital allocation choice as opposed to a hard one.

In other words, when great businesses with comfortable financial cushions find their stock to be trading meaningfully below intrinsic value, pretty much no alternative action can benefit shareholders as certainly as buybacks. Buybacks, when done right, are a value investment.

Buffett:

Repurchases [are] sensible for a company when its shares sell at a meaningful discount to conservatively calculated intrinsic value. Indeed disciplined repurchases are the surest way to use funds intelligently: It’s hard to go wrong when you’re buying dollar bills for 80 cents or less. […] But never forget: In repurchase decisions, price is all-important. Value is destroyed when purchases are made above intrinsic value.

So what’s the idea of a buyback when you have dividends as a distribution option? I think Buffett intentionally left out dividends in the above to keep his argument simple. But in deciding how to return capital to shareholders in a way that brings the most value, dividends do matter.

Buybacks vs. Dividends

The main difference between buybacks and dividends—aside from trading cash in hand for increased ownership—is that dividends force taxes upon the shareholder. In contrast, by returning cash through a buyback, the shareholder can themselves decide whether to sell some shares for the income and pay the contingent capital gains tax.

So, assuming the company finds no internal use of its excess cash with a return above its cost of capital, you have a situation where a company can either buy back stock or pay out dividends. The former postpones taxes while the latter doesn’t. So, all else equal, if a company buys back stock at or slightly above intrinsic value, the value to the shareholders should still be higher than paying a dividend. It’s only when the price to intrinsic value gap exceeds the downside of forced tax payment that dividends make more sense. Where the specific gap is, of course, depends on the tax jurisdiction, the various different tax rates (short and long term) that apply in said jurisdiction, and the holding period from when the buyback occurred (if the existing shareholder goes out and sells the stock right after the buyback, there’s no tax benefit, and some jurisdictions even favor dividend taxation).

The caveat is that reality is never ‘all else equal’. Intrinsic value is of probabilistic nature—an intermingled number from a wide range of branches on a huge decision tree of future possibilities. Thus, a dividend is a definite present return that will be taxed whereas a buyback represents an uncertain future return on which tax is deferred until the shares are sold. Investors use different hurdle rates and some might prefer the dividend even as the price is trading at intrinsic value.

But even so, there’s another reason why companies may opt for buybacks as opposed to dividends which relates to expectations. Dividends are sticky. Once a company pays them, it can’t bounce them around and shareholders come to rely on them. The result is a plan that makes sense in one year and in another year doesn’t. In contrast, a company is under no obligation to complete its stated buyback program.

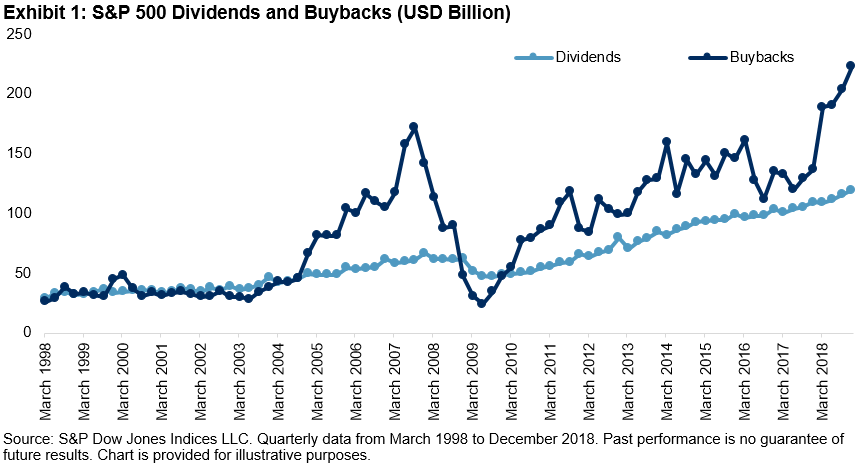

All these rationales have made buybacks widely popular, swamping dividend payouts for the past 17 years:

But there’s a feedback effect to this phenomenon: Because a buyback boosts the share price as opposed to a dividend which depresses it (on the ex-dividend date the share price can be expected to drop by the amount of the dividend), many market participants now have come to associate buybacks with the hope the stock price never goes down. And because investors are, in the name of behavioral finance, risk-averse (at least that’s what it’s called even though they are actually volatility-averse) many have now tacitly placed the responsibility of smoothening the price action with the company’s management, even if this isn’t at all in the shareholder’s own interest. It’s a form of Goodhart’s Law at scale: When a measure becomes a target, it ceases to be a good measure

.

With careless use of buybacks, shareholders aren’t the only ones to get hurt.

The Macro Perspective

Due to its popularity, buybacks have gotten so much attention from executives, the media, and politicians that legislators have started talking about taxing buybacks at the corporate level. US Senator Elizabeth Warren has said that buybacks create a sugar high for corporations. It boosts prices in the short run, but the real way to boost the value of a corporation is to invest in the future, and they are not doing that.

In 2014, Harvard Business Review claimed that buybacks deserved much of the blame for widened inequality since the financial crisis.

These aren’t new claims. For most of the 20th century, buybacks were mostly illegal as they were deemed market manipulation. Until 1982, a company could only buy back stock through tender offers until the practice on the open market became legal at last. And about a decade after, interest rates started coming down and stock option compensation turned tax deductible, laying the groundwork for massive buyback popularity. In the early 2000s when interest rates were lowered almost to zero, buybacks started getting tightly correlated with corporate debt issuance.

In a macro perspective, the way buybacks are used collectively can be dangerous for the economy because they urge financial risk-taking. Again seen on the chart above, buybacks, which are evidently more volatile than dividends, have dominated shareholder distributions when the market is heating as companies have bought back stock at high prices. In 2019, JPMorgan created a time series that showed that the percentage of buybacks that have been funded by debt has been far higher near market tops than bottoms.

So as history shows, companies in aggregate tend to not invest in their own stock as a value investor would. They buy high and, if they sell at all, sell low. Why is that?

Abuses of Buybacks

If we now go back to the micro perspective, here’s the main issue with buybacks: Intrinsic value is an abstract subject. What looks cheap to one investor may look expensive to another (although there is only one truth). When something is abstract like buybacks, it’s prone to manipulation and incentives.

That’s why buybacks are sensitive to corporate incentive systems. If a stock option program is too excessive or compensation system too dependent on per share measures, management may not have the shareholder’s or Buffett’s $1 test in mind when buying back stock. In Reuters’ words, stock buybacks enrich the bosses even when business sags.

A cosmetically increasing EPS figure may be the final push for a big stock option payday, even if it brings no value to the existing shareholders or lower-rank employees. Value creation turns to value extraction. Buybacks turn into a red herring.

A red flag is one where you see the company buying back a lot of stock but the share count outstanding doesn’t go down year to year. When a mass of granted employee stock options is exercised by employees, a company would need to either buy back stock or issue them. And to avoid diluting earnings per share, it would often opt for the former. However, there’s no logical economic rationale for doing buybacks to offset dilution from the exercise of employee stock options at any price. But companies do it anyway.

Even so, in light of possible buyback manipulation and a gloomy macro perspective, here’s the good news: If you can effectively assess the company’s intrinsic value, it should be easy for you to judge the competency of management by looking at how they act around the share price. And in order for you to judge whether a company buys back stock intelligently or carelessly, you would always need to take a look at its incentive system and opt for a system that doesn’t reward short-term earnings targets and which requires executives to hold stock for years; one which rewards long-term behavior.

Our conclusion is this: Whether a buyback is good or bad depends on each individual company’s circumstances, opportunities, and incentive systems, and investors shouldn’t judge a stock based solely on the company’s buyback program. In any case, buying back stock at a meaningful discount to intrinsic value is almost always a sensible thing to do. If you invest in a company that keeps buying back its own stock, better hope for the price to stay low.