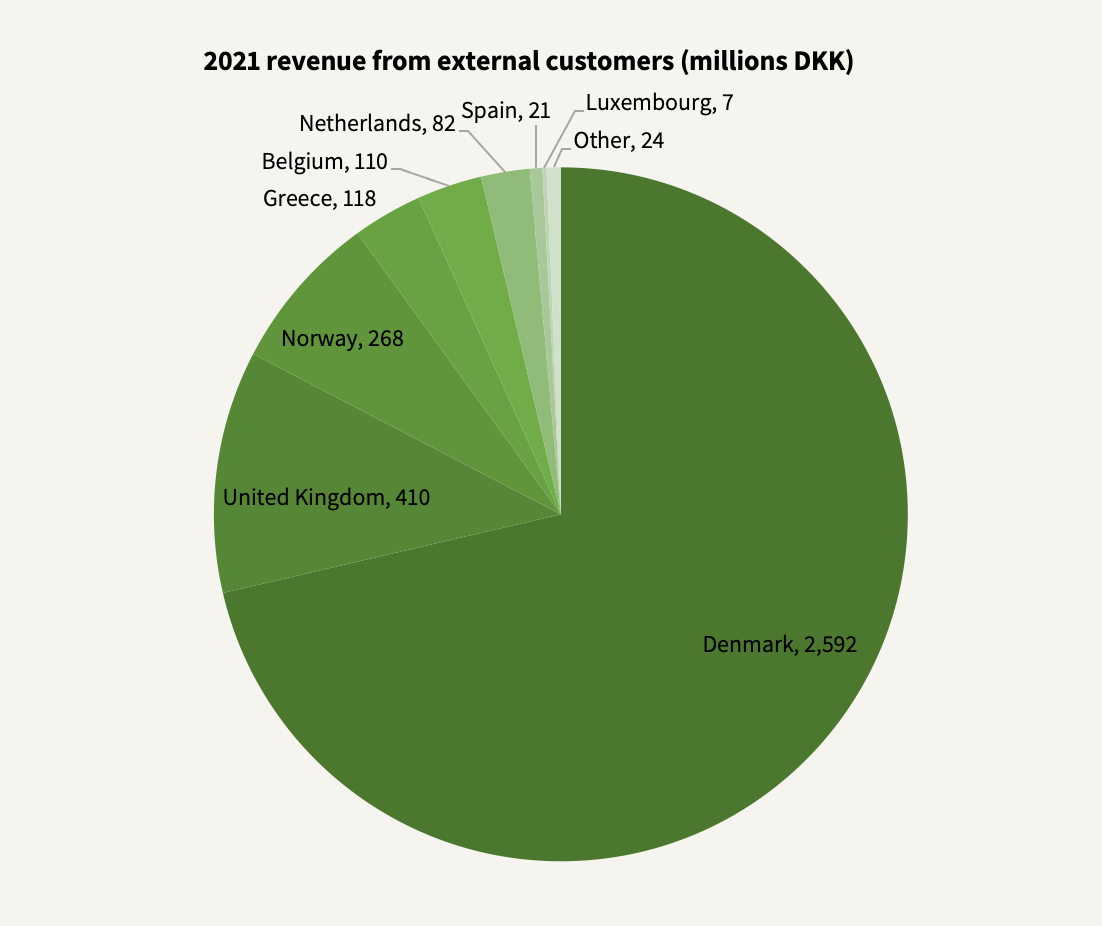

Netcompany is a Next-Gen IT consulting company that develops and maintains digital platforms, core systems, and interfaces for enterprises (39% of revenues) and public customers and authorities (61% of revenues). In Denmark, a country that accounts for 71% of Netcompany’s revenues, the company has delivered some of the country’s most socially critical solutions like Borger.dk (the citizen’s interface for public matters), Sundhed.dk (the citizen’s interface for health matters), the handling of public pension payments, the tax collection system, the main public schooling interface, and the official Covid-19 tracing app.

Society-critical projects like these are not easy to win over, nor finish. It requires long public tender procedures, multi-year contracts, and negotiations (a public project usually takes about 12 to 18 months in the developing stage which spills over to maintenance over the next 5 to 7 years). Even so, Netcompany has consistently won >65% of the public tenders that it bids on and has consistently finished its projects on time and on point.

Part of this competitive win rate can be explained by critical mass that allows Netcompany to handle huge projects. The other more important part has to do with its reputational advantage.

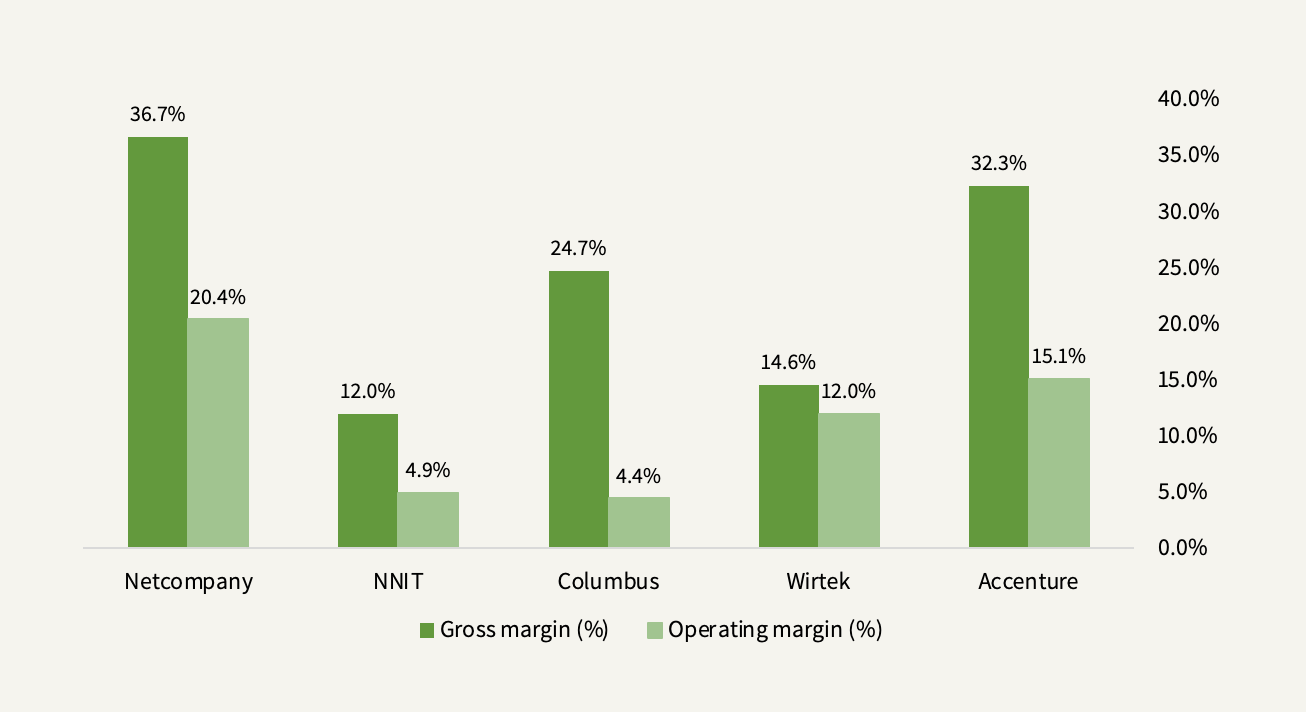

Organizationally, Netcompany is a management consulting firm. But rather than billing by the hour, Netcompany takes on more fixed-cost projects than its competitors which allows the company to optimize margins by efficiency but also exposes it to financial losses if a project crosses the deadline (in fixed-pricing projects, consulting firms usually pay daily fines once the agreed-upon timeline is exceeded). Historically, though, the latter point hasn’t been much of a problem for Netcompany, or at all. If anything, Netcompany’s intense focus on getting projects done on time is pretty much what’s allowed the company to historically generate operating margins in the low-20s, an impressive feat looking across peers:

Some of this profitability can be explained by the culture. Netcompany operates a decentralized management model and has no sales department. Sales, cooperation, and delivery are done by the same developers who work on the project (clients appreciate it when a tech-savvy person can explain complex technical issues to them in plain language) which makes the developers selective in terms of what projects to bid on. Furthermore, the average employee is in their mid-30s of age. These young (and cheap) developers are incentivized to work hard and fast in an organization that rewards ambition with fast progression. I know, this isn’t any revolutionary model in consulting, but consider the fact that Netcompany’s Danish peers are on average almost ten years older. There are only so and so good tech developers in the job market that are also young, cheap, and ambitious. Netcompany’s reputation feeds over to its ability to be first in line to hire and retain the most talented engineers from top local universities.

So it seems Netcompany has cracked the uncrackable code of delivering projects on time, on budget, and highly profitably, all of which have led to a significant reputational advantage which is a key value proposition to capture market share in an IT consulting industry that tends toward fragmentation. With massive digitalization upgrades impending from the switch of on-premise solutions to agile cloud systems all across Europe, the TAM is huge (which I’ll return to in a minute) and reputation is alpha omega. For a company or public entity that looks to replace an antiquated, but functioning on-premise system, it’s equivalent to replacing the machine that supplies the company with oxygen. Customers can’t afford to select a bad vendor.

Even though Netcompany is a market leader in Denmark and has delivered mission-critical systems to some of the largest local, non-public entities, including Topdanmark (with an end-to-end workflow platform), DSV (with an elastic system landscape platform), and Novo Nordisk (with an analytics and stakeholder engagement platform), it still “only” holds a little over 10% market share in the country. Denmark, which is considered the most digitized country by the UN in relation to the public sector, has an IT sector that grows ~2-3%/year and a government that is highly focused on continuing to integrate new technologies in the public sector and enhance the digital skills of Danes to be equipped for the digital economy.

So there looks to be plenty of room to grab share in the core market, and the Danish Netcompany unit, which generated a 23% EBITA margin in 2021, is the cash cow from which project experiments flow to units across the border and from which Netcompany do enjoy some scale advantages. What scale advantages can a bespoke IT consulting business possibly have, you ask? Well, first, there’s the scale advantage inherent in being huge when dealing with public tenders (hence the high bid winning rate). Secondly, even though Netcompany doesn’t deliver horizontal market software (as a first party), there can be many overlaps between projects.

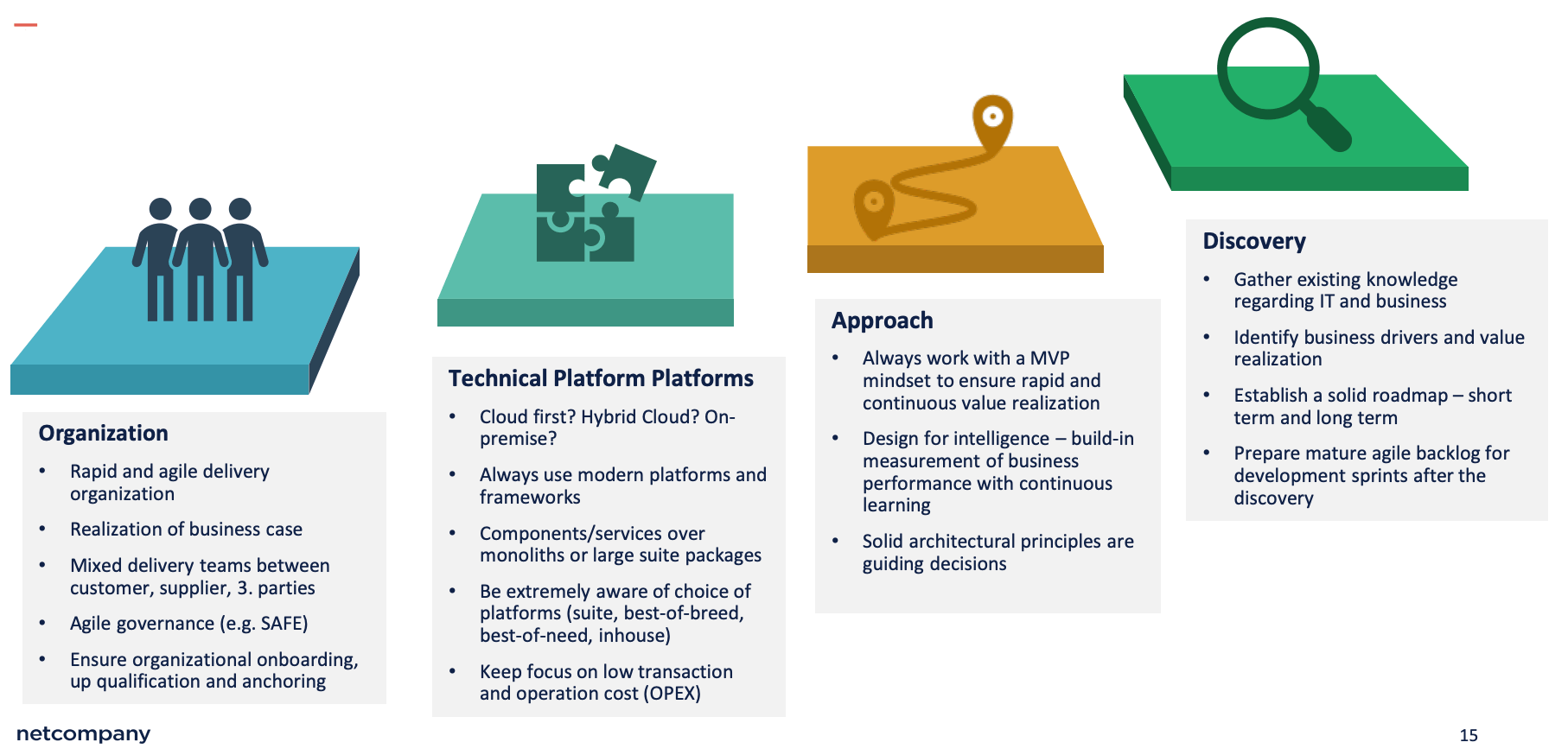

That’s why in 2020 Netcompany launched the “Govtech Framework” (GF), a more than 2,000 components-based collection of society-critical solutions that allows the company to visualize to customers how they can optimally assemble the right tech stack for their use cases. As Netcompany builds new solutions and gathers increasing technological knowledge and expertise in different use cases, it’s (seemingly) only a matter of assembling the pieces to solve the customer’s problem—at least, that’s my perception of the workflow gathered from company reports. For instance, in Norway, Netcompany has built the toll road payment solution to Fjellinjen Utsteder, has been selected strategic partner to the Norwegian Medicines Agency, and has developed the main app for tracing Covid-19 incidents. In two out of three of these projects, Netcompany had previously built equivalent solutions in Denmark. Since Denmark is a notoriously digitized nation at the envy of many other European countries, one could argue that any solution working either for a public entity or a business vertical is a potential, high-incremental margin export.

For business customers, Netcompany offers something of the same sort in the “Composable Enterprise Framework” (CEF) which promises a flexible and composable IT stack with no hard vendor lock-ins by allowing businesses to combine standard software components free of IP restrictions and with full user rights.

The mix of GF and CEF makes up Netcompany’s collective platform approach:

In theory, you’d think that the components-based consulting model would scale well with little constraints: You use fewer developer hours in creating the same product, reduce time to market, offer a cheaper price to your customers, while your incremental margins should go up. But if only it was that simple. “Consultingware”, which GF and CEF are collections of, aren’t nearly as scalable as SaaS. While it’s possible to reuse code, this is such a small part of the overall project process that doesn’t hold a lot of value, and it’s hard to find consulting projects that are so similar that you can directly apply code from one to another. Granted, some projects can be packaged and resold as products to a certain degree. The ongoing JV with Copenhagen Airport in which Netcompany creates a new standard for full-stack airport operating systems is an exciting example of a system that could theoretically be an export product to efficiency-driven airports around the world.

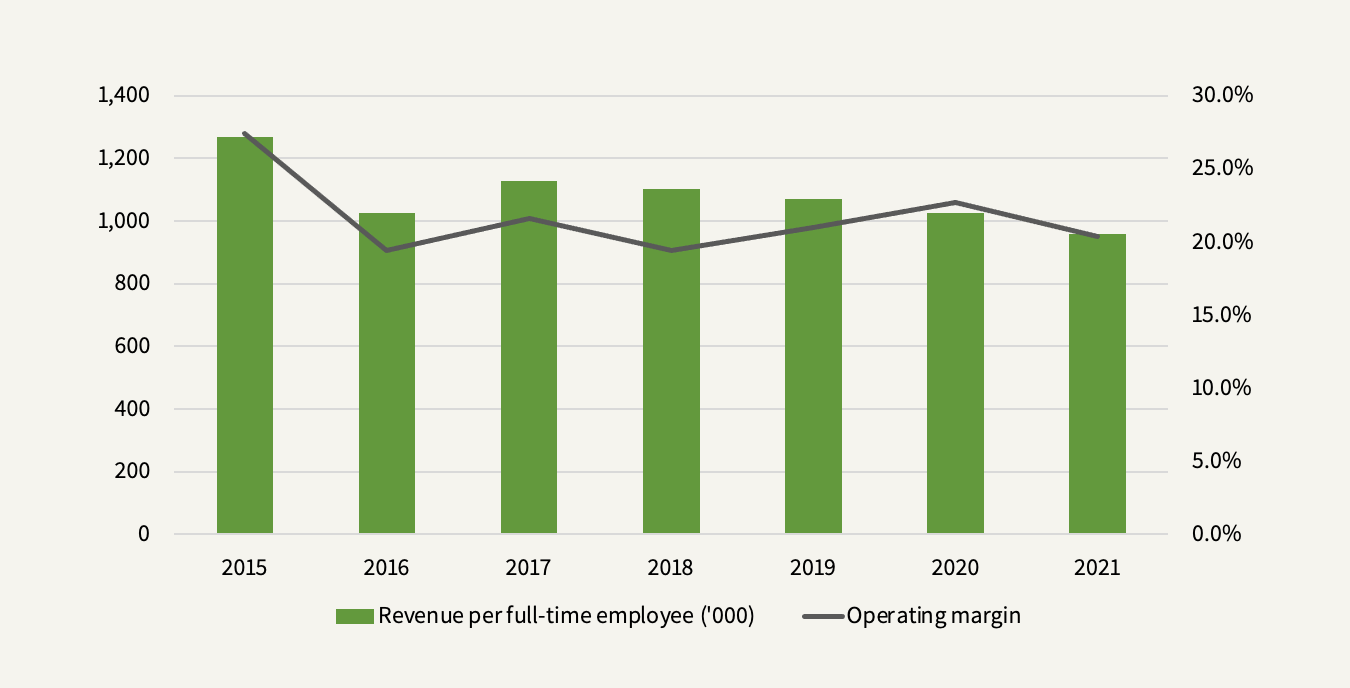

But as much as IT consulting is a project management business, it’s even more a people management business. Which is why I think the scale advantage that Netcompany enjoys ends with its product and organic growth potential, which is another way of saying that it doesn’t work once a consulting business tries to grow internationally by M&A. As a human capital intensive business, you’d want to see revenue per employee go up in line with economies of scale which hasn’t been the case for the past six years:

Management indirectly blames this trend on ongoing M&A integrations. For these past five or so years, Netcompany has expanded by acquisitions into seven European countries other than Denmark: 1) Norway in 2016 following the acquisition of Mesan (1.6x forward sales, 7x forward EBITA) with a current addressable market share of 1.7%, 2) the UK, the largest addressable market in Europe, in 2017 following the acquisition of the country’s fastest-growing IT company Hunter Macdonald (1.2x sales, 16.5x EBITA) with a current addressable market share of 0.2%, 3) the Netherlands in 2019 following the acquisition of QDelft (0.8x sales, 11.5x EBITA) with a market share of 0.2%, and 4) Belgium (4.6% market share), Spain (0.1% market share), Luxembourg (12% market share), and Greece (4.8% market share) in 2021 following the company’s largest acquisition to date of Intrasoft (1.1x sales, 24x EBIT).

Needless to say, with Netcompany’s low market shares in each market, the TAMs should provide significant potential growth runways with each market growing somewhere around 3-5%/year, regardless of whether Netcompany decides to grow organically or non-organically. Since 2016, organic revenue growth has on average exceeded 20%/year with the vast majority of that growth attributed to Denmark while acquisitive growth from the aforementioned M&A across the border has exceeded 10%/year.

Business in Denmark has been wonderful and highly cash flow generative. And so, Netcompany decided to take its free cash flows and step on the gas by crossing the border through M&A. However, it found that integrating the acquired businesses—with all their cultural differences—into the “Netcompany methodology” has been a difficult and slow process. To put it frankly, it’s been less than stellar. A little over five years after the acquisition of Mesan in Norway, there’s still work to be done in terms of higher-level management issues and tender writing procedures. And although revenue growth has been satisfactory (~15% CAGR), the unit’s EBITA margin has decreased to less than half of what it was by the time of acquisition in 2016.

Furthermore, five years after the Hunter Macdonald acquisition, the UK division is still working on converting its use of contractors to full-time employees to keep talent in house while strengthening the manager level to support the pyramid structure (pretty much the same issues as Mesan, but different wording). Partly hit hard by Covid, the division has grown about 5%/year since the acquisition in 2017. The profitability story is the same as the Norway unit. The Netherlands unit, a bit earlier in the integration process, has so far suffered a similar fate on profitability.

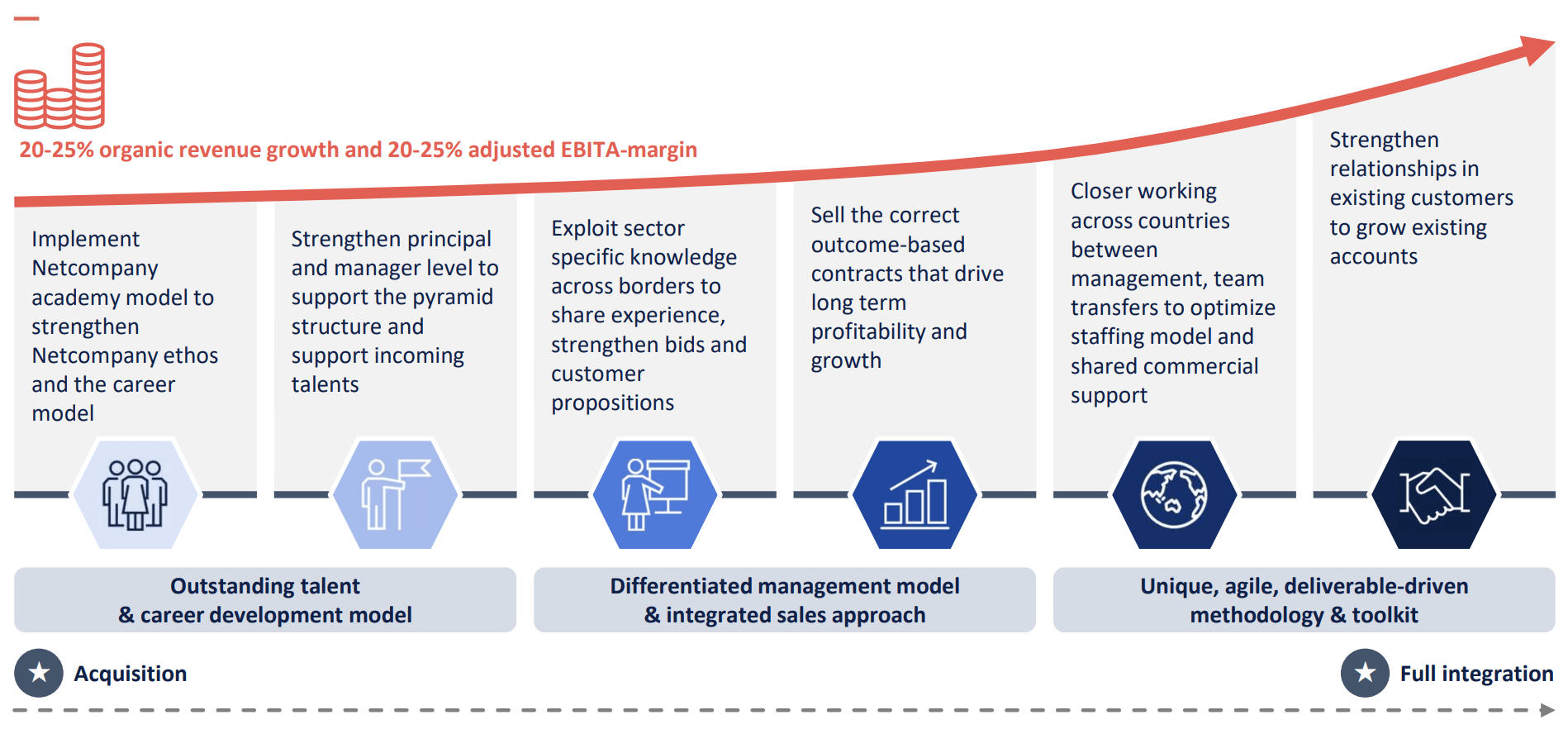

All of which isn’t exactly following the company’s 3-5 year integration framework that management includes in every capital market day presentation:

It’s not a bit easy to integrate two human capital-intensive businesses, especially when those two businesses are in different countries. In other words, Europe is not an easy region for conducting horizontal M&A. From the end of 2019 to the end of 2021, Netcompany’s number of full-time employees has increased a whopping 160% from 2,500 to more than 6,500 with ~95% of those working with client-facing activities. It’s a giant task to groom all this new staff in the Netcompany methodology.

This is why management has decided that it won’t do so with the Intrasoft acquisition that brought in more than 2,800 FTEs. Intrasoft will continue to operate as a stand-alone entity, except for projects that overlap. Yes, it may have to do with the fact that this acquisition was about twice as big (DKK 1,375mln) as the company’s historical acquisitions combined, but I also think it emphasizes management’s struggles with getting the integration model to work. Time will tell what Netcompany plans to do with the business. After all, despite the nice order backlog of DKK 6,500mln until 2028, Intrasoft is not nearly as good a business as Netcompany so the acquisition is likely to dilute overall margins for years to come.

Moreover, now going with greenfield expansion in Sweden (and perhaps Finland) over the coming few years, it seems as though management has learned that perhaps the company should reach for cross-border growth organically. With that in mind, Netcompany has surely not made its last acquisition.

Despite my gloomy perspective on the M&A capabilities, it shouldn’t take anything away from the fact that the Danish unit is a damn good business growing ~20%/year with a 23% EBITA margin (equal to 3x tangible assets), and negligible reinvestment requirements. When Netcompany crossed its 1,000th employee, it was the first time for a Danish startup to do so in the past 20 years—a feat highly attributable to the exceptional entrepreneurship conducted under co-founder and CEO André Rogaczewski, a long-term thinking, highly empathetic leader and visionary. I have equally high praise to give to the chairman Bo Rygaard, appointed in 2019, who joined the board from the private equity fund FSN Capital (who listed Netcompany) in 2016. Considering the competent management team in place, I would venture to guess that Netcompany will eventually find a way out of its integration issues. When that is, though, I don’t know.

Netcompany is a growth company with a nice incentive-induced culture that creates immense value for customers and shareholders by being at the forefront of innovation and efficiency from utilizing people skills. But still, I’m wary of how the company’s fast growth through acquisition will transcend to increased earnings generation if management is adamant about continuing down that road to fulfill its vision of becoming the digital market leader in Europe. If Netcompany can’t catch up with its own integration timeline then it won’t get the numbers necessary to support its own margin projections as the ex-Denmark units will pick up growth and take a bigger share of the revenue pie. Earnings growth and returns on capital will suffer as a result. Time will tell.

At a 1.9% FCF yield, what you pay is for a lot of the story to work out. The company started paying a dividend (DKK 50mln) and executed buybacks (DKK 100mln) in 2021 out of DKK 408mln in free cash flow (excluding acquisitions). The buybacks may continue at the same level in 2022 but dividends will be held off to pay down the increased debt from the Intrasoft acquisition that took net debt/EBITDA to 3x. Management thinks the stock is cheap. On January 27th, when the stock price was almost 50% off ATH, Rogaczewski and of the other co-founders Claus Jørgensen (who’s the COO) each bought chunks of shares for DKK 50mln. The stock is currently down 7% from then. I’m certainly enthusiastic about Netcompany’s vision of becoming a European digital leader but prudent about how management expects to get there. At this FCF yield, with shaky margin volatility and ROIC questions on the horizon, there are surer stocks out there to pick when decades-long growth is this big a part of the equation.