In chess, there’s a viable strategy called seizing the middle. By seizing control of the middle board, a player maximizes the potential moves and controls the movement of the maximum number of pieces.

In China, there’s a tech company utilizing this strategy. And it has beaten all its competitors who have tried to do the same thing.

This company is Autohome and it sits right in the center of the automobile industry by seeking to effectively link each stage of a car buyer’s ownership life cycle with the corresponding stage of their customers’ sales cycle.

Autohome has been a holding in the Junto investment portfolio since March 20, 2020, and you’ll soon learn why.

At its core, Autohome is a content platform delivering comprehensive content to automobile consumers through its websites, autohome.com.cn and che168.com, and associated mobile apps. This content is both professionally generated, user-generated, and (increasingly) interactive covering the entire car purchase and ownership cycle.

The company was founded in 2005 by entrepreneur Li Xiang. Li identified a gap in the market when he wanted to buy a car but couldn’t find any useful information online to guide his decision. So he started a website himself. By focusing relentlessly on helping consumers find the right car, being extremely frugal, and funding growth entirely from retained earnings, Autohome grew quickly into a massive content platform. Together with its interactive community, this groundwork has made Autohome the most popular online auto content among Chinese internet users and one of the most preferred platforms for automakers and dealers to conduct their marketing and advertising campaigns. By the end of the fiscal year 2019, Autohome had over 110 million registered users in its user community and the daily active site-wide user count by the latest figures showed 42.1 million.

In recent years, the company’s competitive strategy has been to transform this content-led vertical media business into a full data and technology-driven automotive eco-platform. Let’s dive further into what this means.

Three Ways to Capture the Automobile Ownership Lifecycle

Autohome is a good example of a multi-sided network. It sits right in the middle of car manufacturers, dealers, consumers, and fans through its three main business segments: media services, leads generation services, and online marketplace, and others.

Through media services, Autohome acts as an advertising platform for automakers and manufacturers which they typically utilize for brand promotion, new model releases, and sales promotions.

Just like social media advertising platforms, these advertisers gain access to very granular data on car consumers in order to target campaigns efficiently and with timely insights. But unlike generalized data on geographic location, interests, and so forth, Autohome has got a big insight into real automotive interests around their users. For example, by utilizing text processing, Autohome analyzes user posts and other user-generated content in its community to evaluate behavioral patterns around specific car brands, models, what they specifically like, what they specifically hate, etc. This stuff is invaluable to an automaker.

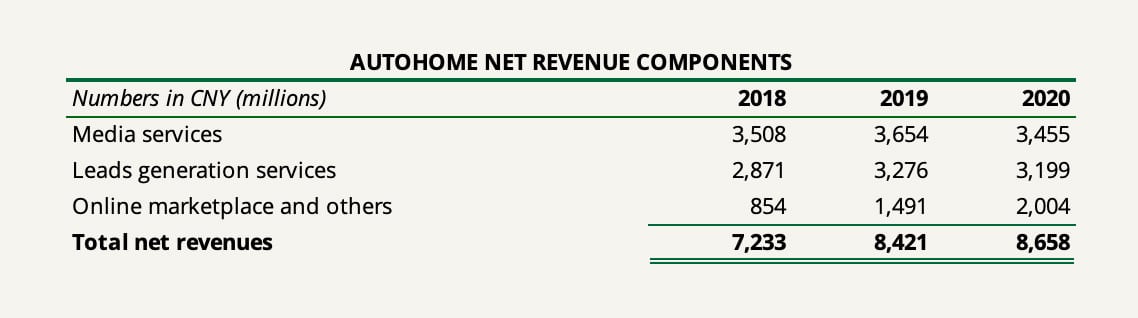

Furthermore, Autohome itself derives from the data ideas for how and where they can push out large-scale test driving events in collaboration with specific automakers all around China. By the end of the fiscal year 2019, Autohome counted 92 automakers (including joint ventures) as their end customers for media services with the top five comprising 24% of the segment revenue. The media services segment is Autohome’s largest with the fiscal year 2020 revenues of about CNY3.5 billion.

The leads generation services segment acts as a membership model for auto dealers. These auto dealers can build their own online store on Autohome’s platform, market their entire inventory easily with little technical acumen, and gain access to a wide range of Autohome’s data products. Potential car buyers can then interact directly with the dealer to purchase a car and Autohome acts as the lead generator for the dealer.

Now, here’s the interesting thing about the leads generation service business.

By the end of the fiscal year 2019, Autohome provided leads generation services to 27,100 dealers across China. In 2018, the number was 28,613, and the year prior, 27,167 – basically a flat development.

According to the China Automotive Dealers Association, the total number of authorized 4S dealers (meaning full-service dealers that offer sales, service, spare parts, and surveys) in the country was 29,664 in 2018. While there are obviously many dealerships other than full-service, this certainly indicates that the customer base of dealerships is largely penetrated.

Yet, net revenue in leads generation services has increased from a level of CNY2.3 billion in fiscal year 2017 to CNY3.2 billion in the fiscal year 2019 all led by price hikes and value-added services. In fact, for the past 7-8 years, Autohome has hiked subscription prices for dealers by about 20% per year (except for the extraordinary year of 2020). And still, Autohome continues to own the dealership segment because the product is so sticky. Auto dealers can’t afford to get out of the loop. If you’re a Chinese local auto dealer and you haven’t marketed your inventory on Autohome’s platform yet, good luck competing against the competitor across the street.

To dealers, Autohome offers two pricing models: a fixed pricing model with an annual fixed subscription (subject to price hikes) or a floating pricing model in which the price depends on the number of leads that Autohome can generate in the dealer’s online store. Historically, the majority of dealers were under the fixed pricing model, but increasingly, Autohome has encouraged dealers to move to the floating pricing model as a testament to their ability to generate high-quality leads. This pretty much puts the risk in Autohome’s hands, but as long as they can successfully drive high-quality prospects, it’s a win-win solution. For the dealers who signed the floating pricing contracts, Autohome damn wants to make sure that they get excessive leads and leverage their own earnings potential.

The last segment, online marketplace and others, is the smallest but the fastest growing. Autohome Mall is a full-service transaction platform for users to review auto information, purchase coupons offered by automakers, and complete purchase transactions directly on the platform for later to be picked up at a dealer. Recently, in 2018, Autohome invested in TPP, a platform facilitating C2B transactions of used cars which is now (according to management) the largest of its kind in China.

To complete the touchpoint of the car ownership cycle, Autohome facilitates financial services from cooporative financial institutions offering primarily loans and insurance products while charging a service fee per sale of lead.

Lastly, to bring together the value chain, Autohome offers data-driven SaaS products in the form of sales and marketing tools to automaker and dealer customers by utilizing its AI, big data, and cloud capabilities. Through these data products, dealers get comprehensive assistance in leads to install visits, sales, and ultimately to the up-sales, covering the full spectrum cycle of auto ownership and increasing the conversion rate each step of the way. By bringing data products to the table, Autohome has reinforced the entire ecosystem by providing highly differentiated value to their customers up the value chain. The more customers get hooked by Autohome’s primary offerings (with success), the easier sell these intelligent tools become. The company’s latest Smart Store 2.0 data product has reached a dealer base of 2,700.

The following shows net revenues in each segment for the fiscal years of 2018, 2019, and 2020.

Now, I have already spent too much time and space diving into the nuts and bolts of Autohome’s business. I guess you wonder why the title of this note says it’s about Autohome’s prospects for allocation while I ramble on breaking down the business.

Rest assured that there is purpose behind the madness.

Reading my break-down, you should have one thing in mind: that this is probably a very capital-light business model with a short cash conversion cycle. And so it is. These are the impressions I wanted to distill as we move onto the next section.

This means that I will not provide a full industry and competitive overview of the online automotive industry here. Just know that Autohome’s closest competitors are BitAuto, Dongchedi, Xcar, and PCauto with BitAuto being the closest one. BitAuto has operated unprofitably for the past five years and was taken private in 2020.

Remark: Once a part of Autohome Mall, Autohome tried to hold inventory for direct vehicle sales which was fully cleared in 2017 in order to become a fully asset-light facilitation business. The strategic shift resulted in a gross margin increase from 65.7% in 2016 to 91.9% In 2018.

Autohome Drowns in Cash

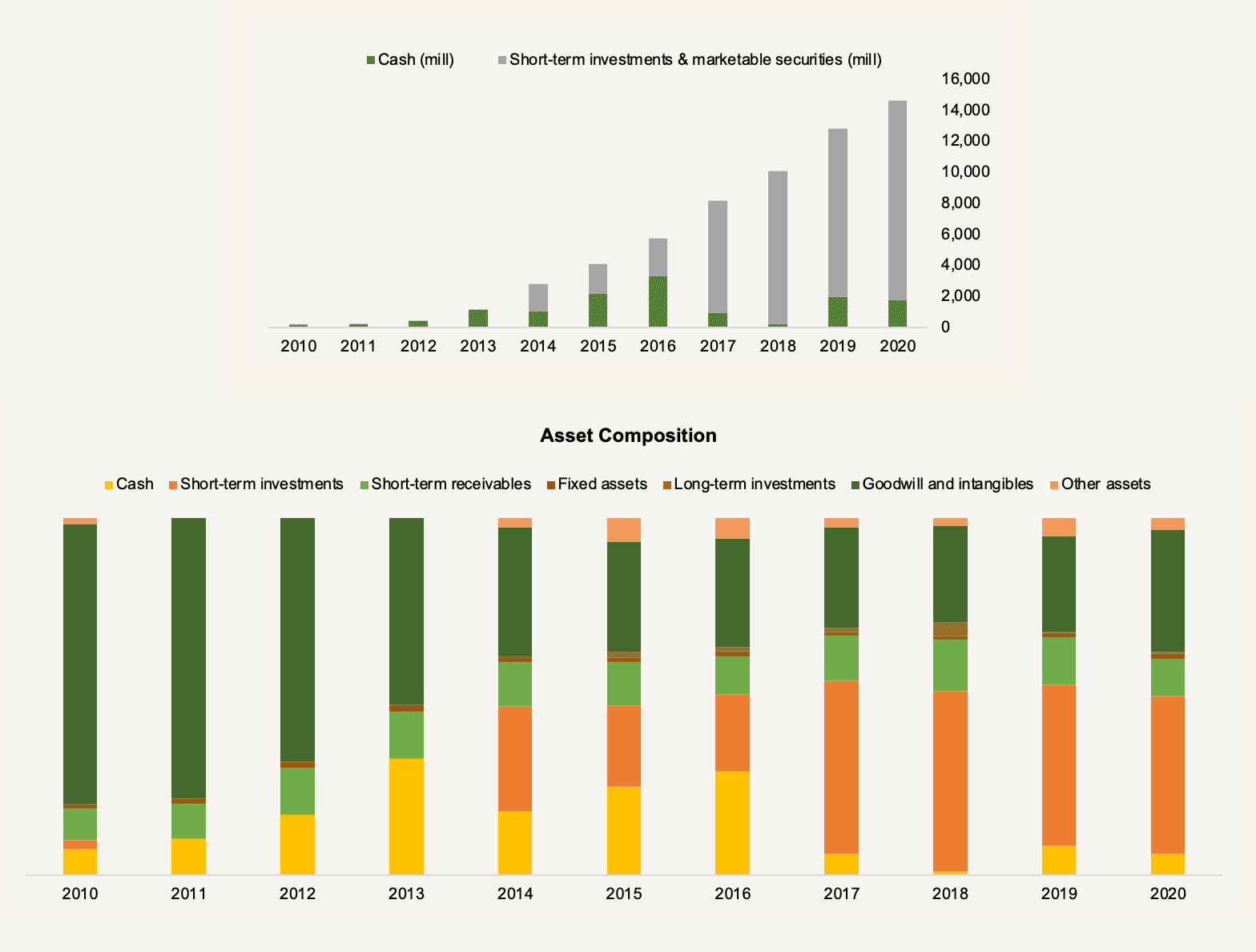

Despite investing heavily in innovation – which we will return to in a minute – Autohome is quickly turning into a company that looks to generate more cash than it knows what to do with.

All originating from retained earnings, the result has been a growing cash pile allocated to short-term investments and marketable securities.

What is management to do with this pile?

Let’s first look at much capital Autohome’s business requires in its operations. Then, let’s examine the current returns that Autohome makes on that capital in operating earnings (i.e., we strip out earnings from non-operating assets such as those originating from marketable securities). And lastly, let’s discuss the different options and probabilities of how the excess capital might be allocated going forward.

The Capital Required for Operations

My last Junto note was a lengthy piece on how to properly think about return on invested capital and its components. In the note, I used PepsiCo as a demonstration. In light of that, it would only be fair to do the same thing with Autohome to get a better sense of how I think through these things.

First, we must assess whether Autohome’s reported earnings and balance sheet properly reflect the economic reality of the business. If not, we adjust accordingly.

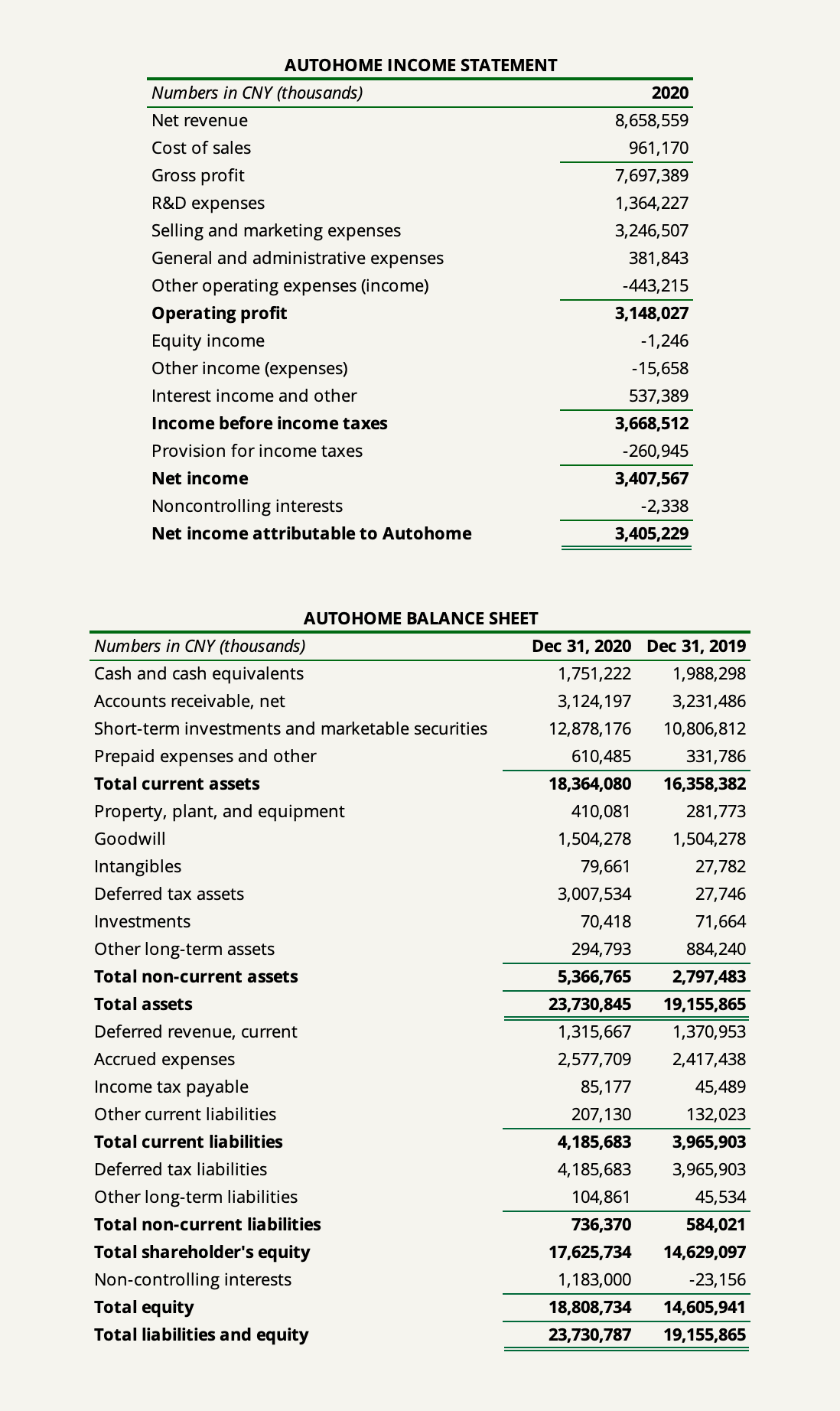

The following shows Autohome’s accounting income statement and balance sheet as of the end of the fiscal year 2020.

A few things stand out. First, Autohome has no debt and the balance sheet is remarkably solid with the vast majority of it comprising liquid assets. The company adopted the ASU 2016-02 accounting standard for capitalizing operating leases from January 1, 2019, and its operating lease right-of-use assets are therefore already included within other long-term assets. If we would technically want to categorize the liabilities associated with the leases as debt, the total of that according to the annual report 2019 only equaled an insignificant amount of CNY76 million.

Since we work with a relatively young, growing tech business with no debt, our obvious concern would be whether there’s a huge backload which could contingently arise from employee options. Autohome has some, but according to the 2019 annual report, the aggregate intrinsic value of employee options outstanding was estimated to an inconsequential amount of $30.7 million.

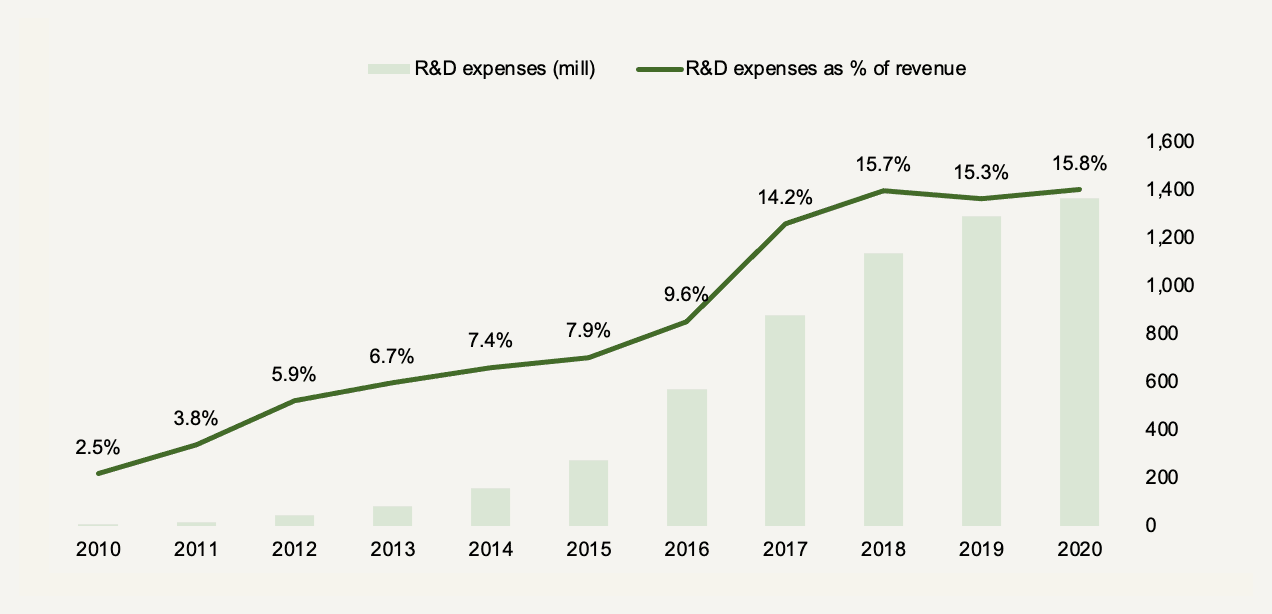

Next, Autohome spent about CNY1.36 billion on research and development in the fiscal year of 2020. It spent about the same amount the year prior which has been ramped up significantly over the years.

These efforts are going into strengthening the company’s technological capabilities, especially in the fast-growing marketplace and others segment in terms of artificial intelligence, big data, and cloud technologies. For example, in 2017, Autohome came up with the idea of launching a virtual showroom and auto show on the back of their significant investments in AR and VR. In the virtual showroom, virtual vehicles could be explored in three dimensions and could be taken on virtual test drives around virtual cities – talk about interactive content. Innovations as these have become a commercial tipping point for the company, especially within leads generation.

Since plowing funds into R&D efforts like these is obviously intended to provide the business with benefits spanning over many years, it’s a mistake to think about such expenditures as costs rather than investments. But this is what conventional accounting requires because it’s an insurmountable problem to figure out the exact worth of these R&D efforts. Some R&D investments will turn out worthless as sunk costs and others may provide a breakthrough of an asset on which the company can surf for many years to come.

However, it doesn’t change the fact that our goal is to look at the economic reality behind the business. And the economic reality is that Autohome’s previous R&D efforts have turned out to strengthen the user experience of the platform and the company’s horizontal product offering (in the year 2020, data products, in which Autohome sells data-driven sales and marketing tools to dealers and car manufacturers based on their big data capabilities, increased 70% in sales).

The other point to make here is that every R&D effort made by a company may not be directly related to growth investments. Some are maintenance expenditures necessary for a company to make simply in order to maintain their competitive position and earnings level. That is why we must put these efforts on the balance sheet. And when thinking about free cash flows going forward, we must treat further R&D investments as part of capital expenditures.

The same thing goes for brand advertising expenses which are included within selling and marketing expenses. In August 2019, Autohome launched its massive 818 Online Global Auto Show which is the grandest of its kind in the world. The warm-up to the grand event begins two months prior with Autohome throwing activities such as fan festivals, KOL conferences, model races, and Auto Owners’ Day. At the big night, the Global Car Night Gala, more than 30 performers spice up the event while Autohome presents new car releases and collaborates with car brands to make the night entertaining. The goal of the event is for their customers to sell more cars and for the consumer to enjoy the carnival. But the ultimate goal for Autohome is to strengthen its brand.

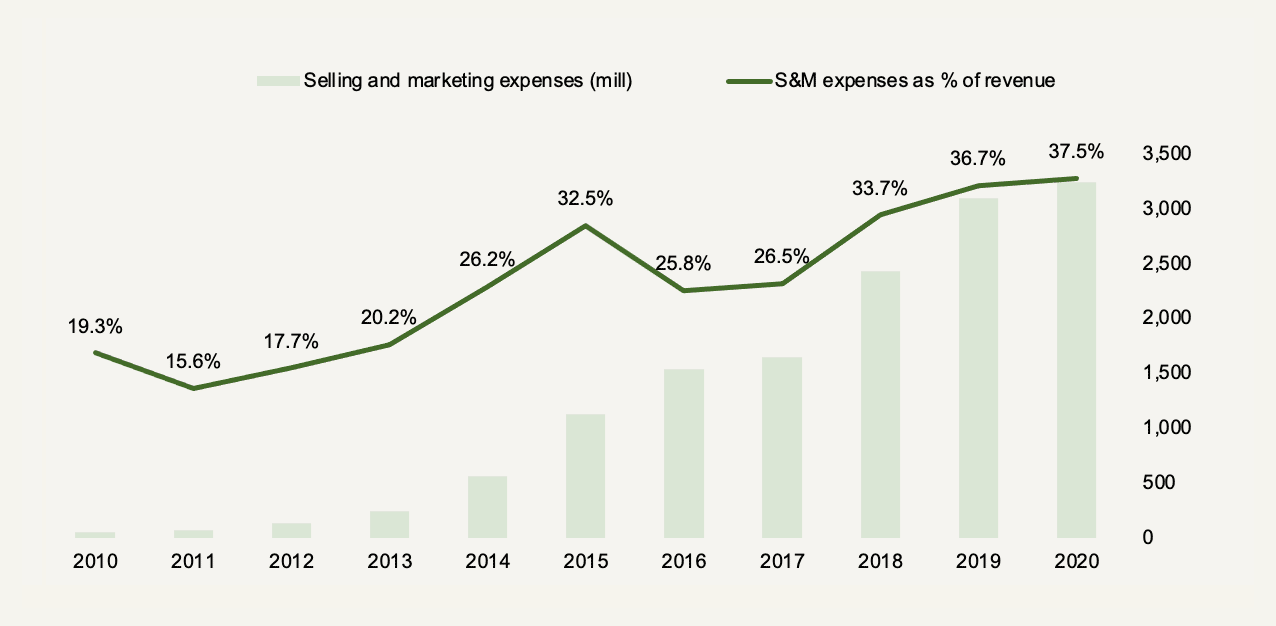

As with R&D, selling and marketing activities are expensed during the period in which they occur which some are rightly so since many selling and marketing activities can be directly attributed to the corresponding revenue generated during the period. But that encompasses marketing efforts that are done directly to strengthen the company’s brand equity.

Autohome spent about CNY3.25 billion on selling and marketing in the fiscal year of 2020. In order to get a realistic view of the capital the company has really invested in the business, we will want to capitalize about half of those expenses since we know from the 2019 annual report that the company’s incurred direct advertising expenses of CNY1.6 billion out of CNY3.1 billion in selling and marketing expenses in the fiscal year of 2019.

Next, we can’t avoid thinking about the large cash pile. Cash is usually netted out of invested capital. However, some cash might be earmarked for a company to reach a state of break-even, some for short-term capital spending needs, and some for day-to-day operations. The younger a company is and the faster it grows, the larger amounts of cash it will usually hold for operations. Generally, the best way to think about operating cash is as a percentage of revenue but it’s really important to know that the amount of cash necessary for operations can differ widely – to the extremes – during different times and different economic environments. For Autohome, we’re going to go ahead and assume that 5% of revenue is required in operating cash.

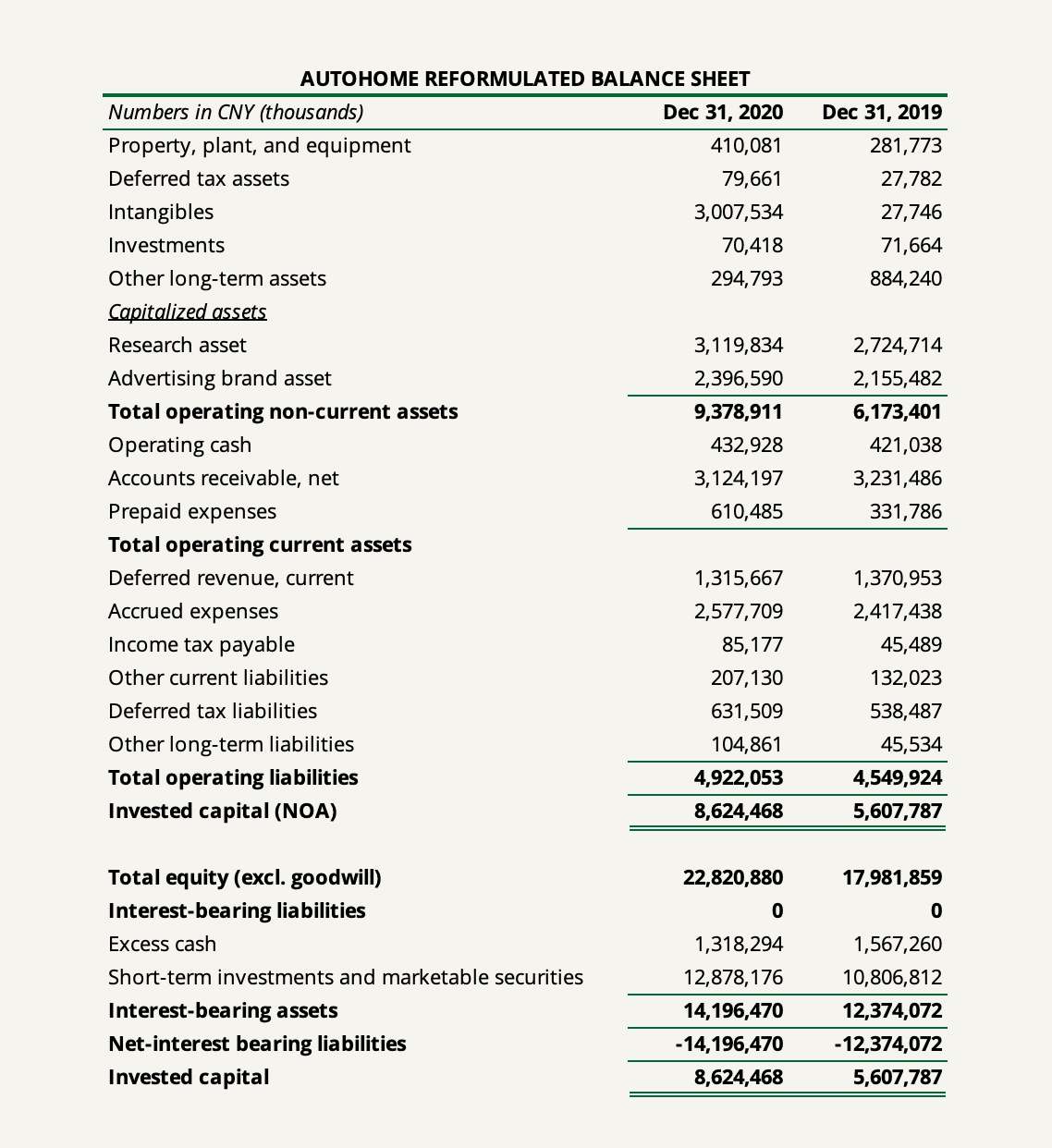

Finally, we can reformulate Autohome’s balance sheet into the following.

As seen, we have netted out goodwill from invested capital. And we can thus estimate that coming into the fiscal year of 2020, Autohome had invested about CNY5.61 billion in operations which had increased to CNY8.62 billion at the beginning of the current year. Note that a significant part of the increase is attributed to non-controlling interests which will be netted out in a valuation.

Observe how much our capitalized research and brand assets comprise invested capital. These are synthetically created based on our accounting adjustments (but probably not any more synthetic than conventional accounting methods make certain other assets).

Note that for our capitalization of R&D and brand advertising part of selling and marketing expenses, we have used an amortization schedule of 4 years for the former and 2 years for the latter. In order to properly capitalize such expenditures, it required using historical expenditures for the prior 4 fiscal years as in the case of R&D.

Let’s move ahead to the earnings that Autohome makes on this capital.

Current Returns on Capital

When thinking about the returns a company makes on its capital invested, we want to get to the core of the earnings generated by operations while separating out the things that are an effect of other non-operating capital allocation decisions.

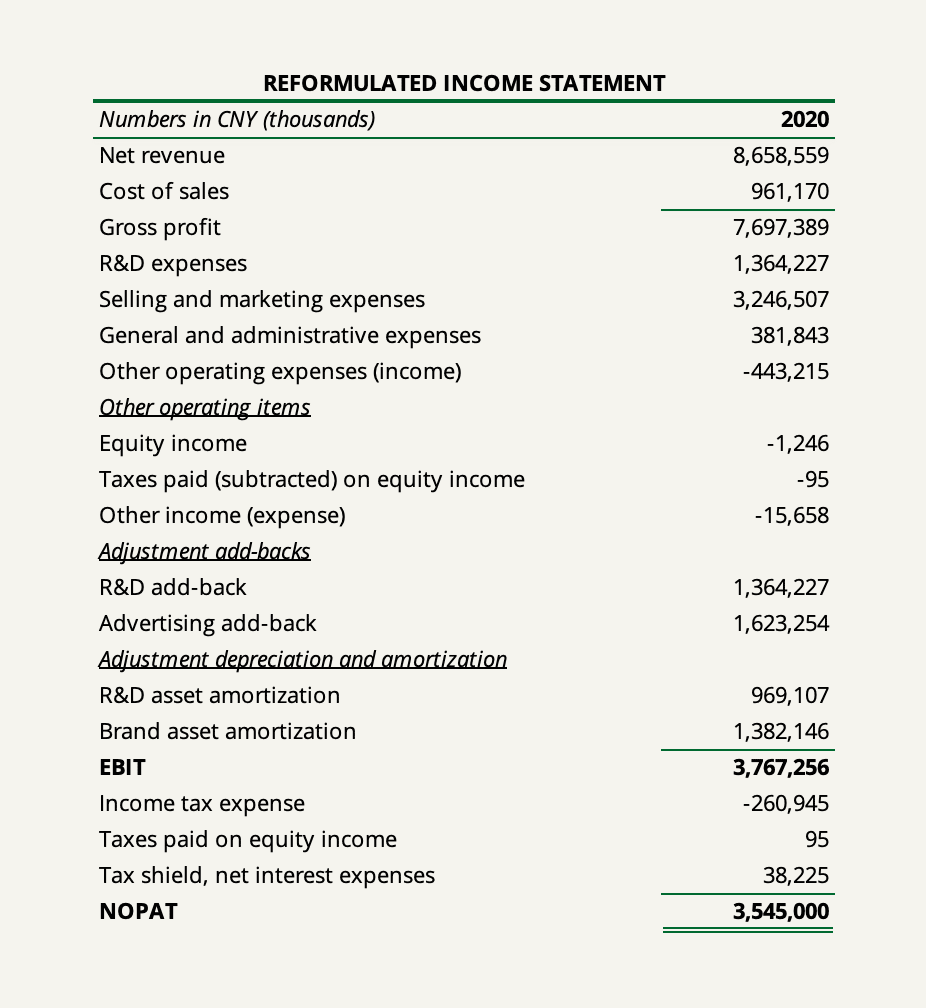

First, in the income statement for the fiscal year of 2020, Autohome showed an operating profit of CNY3.15 billion.

Below the line, we have equity income (arising from investments reported using the equity method) and other income. Both of these items are insignificant in magnitude, so whether we classify them as part of operations or not matters little. However, we would want to include them in operations for the following reasons.

First, as the footnotes to the latest annual report shows, ‘other income’ consists primarily of VAT refunds, government grants, and the like. Considering such grants would not arise without Autohome’s operations, we want to include these as a normal part of doing business. Second, a significant part of Autohome’s equity method investments consists of strategic joint-ventures forming important roles in Autohome’s operations.

Let’s reformulate Autohome’s income statement.

As seen, Autohome’s net interest income of over CNY500 million is netted out to arrive at net operating profit.

Notice that R&D expenses and the capitalized part of selling and marketing expenses are added back while the amortization part of our synthetic assets is charged back. Also notice that we have added back the taxes Autohome saved from losses on equity investments. Since equity method investments are reported on an after-tax basis, we add back the taxes saved before EBIT and charge them again before NOPAT. Lastly, NOPAT is increased by the taxes paid on interest income.

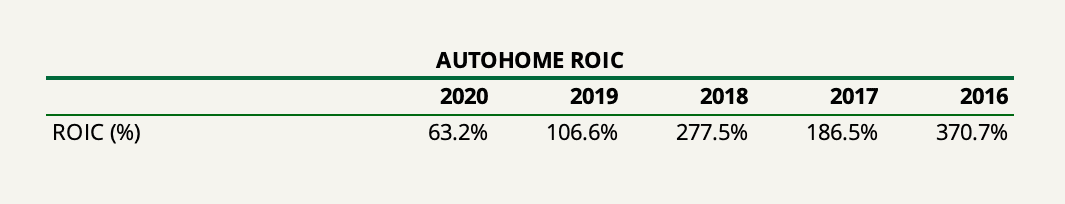

Conclusively, we can estimate Autohome’s return on invested capital for the past trailing twelve months on the basis of the beginning invested capital.

CNY3,545 (NOPAT) / CNY5,608 (Invested Capital) = 63.2%

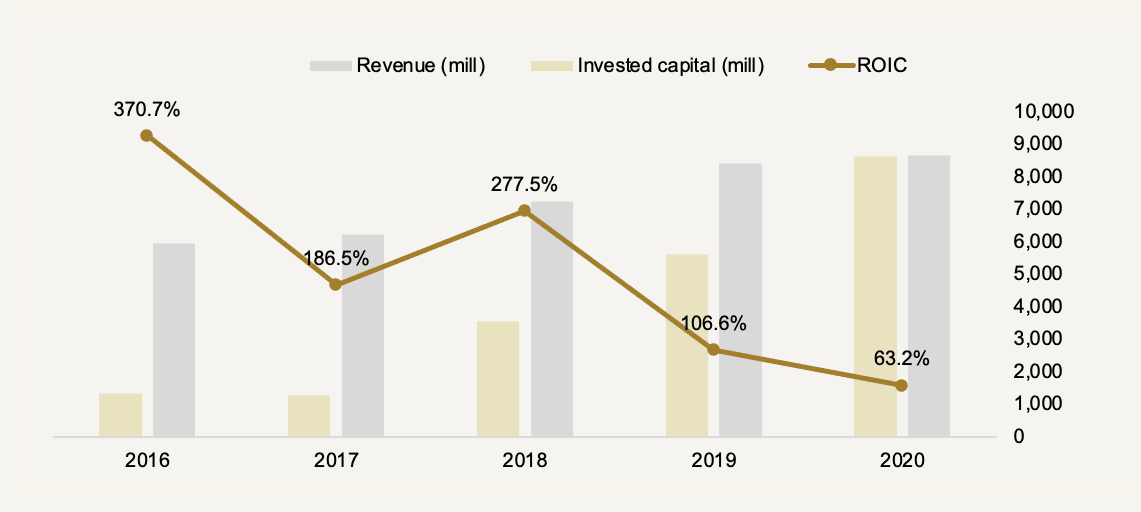

This is a remarkable return. The following shows the calculation for the past five years.

As seen in the following chart, these remarkable returns have incrementally gone down as Autohome has continued to reinvest in product development and marketing.

Prospects for Future Returns on Capital and Reinvestment in Growth

Of course, only knowing the godly returns Autohome has generated in the past is not enough. It’s important to assess how these returns might look in the future.

This assessment rests on two variables: the growth potential and the strength of the company’s moat.

It’s important to not fool ourselves here. On the face of it, Autohome seems to have a big moat around the business. First, reproducing Autohome’s massive content and automobile library of +370,000 articles and +550,000 videos would likely take over a decade and huge amounts of capital to do. Second, as is evident by the competitive situation, Autohome basically operates in a winner-take-all industry. This is because the network effects of Autohome feed on preferential attachment. Automobile users want to be where the most automobile companies are and automobile companies want to be where the most active users are.

Yet, I would argue that the sustainability of Autohome’s competitive advantage does not lie within its massive amount of content. It’s surely a competitive advantage as a top-of-funnel entry point. But is some 5-year old article or video of some powertrain really as valuable today as it was by the time it was released?

Instead, the real robustness of Autohome’s continuous moat (and its ability to widen it) lies ultimately with its competence to entertain, retain, and educate its user base. As for the customers – the automakers, the dealers, ad agencies, and so forth – I don’t question the strength of Autohome’s competitive advantage by being a necessity. Auto dealers can’t possibly compete against local competitors if these competitors market their businesses on Autohome and they themselves do not. We already established that it’s probably why the Chinese dealer market is fully penetrated and why Autohome has been able to aggressively hike dealers’ prices for years. And automakers can’t avoid Autohome simply because the platform (arguably) has the most granular and useful data around the end consumer while allowing automakers to speak to these consumers in the most targeted way. But my point is that none of these competitive advantages will turn out sustainable if Autohome won’t be able to retain users and sustain its large community like it currently does.

I got a feeling that management knows this. And that is why they pile on investments in innovation and expanding the entire ecosystem of the services and bringing value to every part of a car purchaser’s lifecycle. And this is why the 818 Online Global Auto Show is such an intelligent move that in terms of costs takes up a very big part of marketing expenses.

As the current co-president Zhang Jingyu said in a press release at the release of the show:

This is our brand battle. Through ‘Car Evening’, Fan Festival, car model competition, and other brand promotion and user attraction events, we will seamlessly connect online Auto Show and 100 Cities Offline Auto Show to realize sales transformation. Autohome will eventually turn the 818 into a new global auto marketing brand, a new carnival of auto consumption, and a new event of auto culture.

Culture is the keyword. Autohome’s competitive moat expands when the brand gets ever more entrenched in Chinese auto culture.

R&D expenses currently make up about 16% of revenue while selling and marketing expenses take up about 38% with R&D having increased from the single-digit percentage points. As sales grow further, I would expect these common size figures to remain for some years to come. That’s not a bad thing and it does provide us with some clues for what management might do with its excess capital.

Now, what about growth?

In terms of potential, I don’t think there’s much to worry about when thinking long-term. Of course, the slowing growth rate of the Chinese economy has been all the craze in recent years and the automotive market is one of the hardest-hit industries.

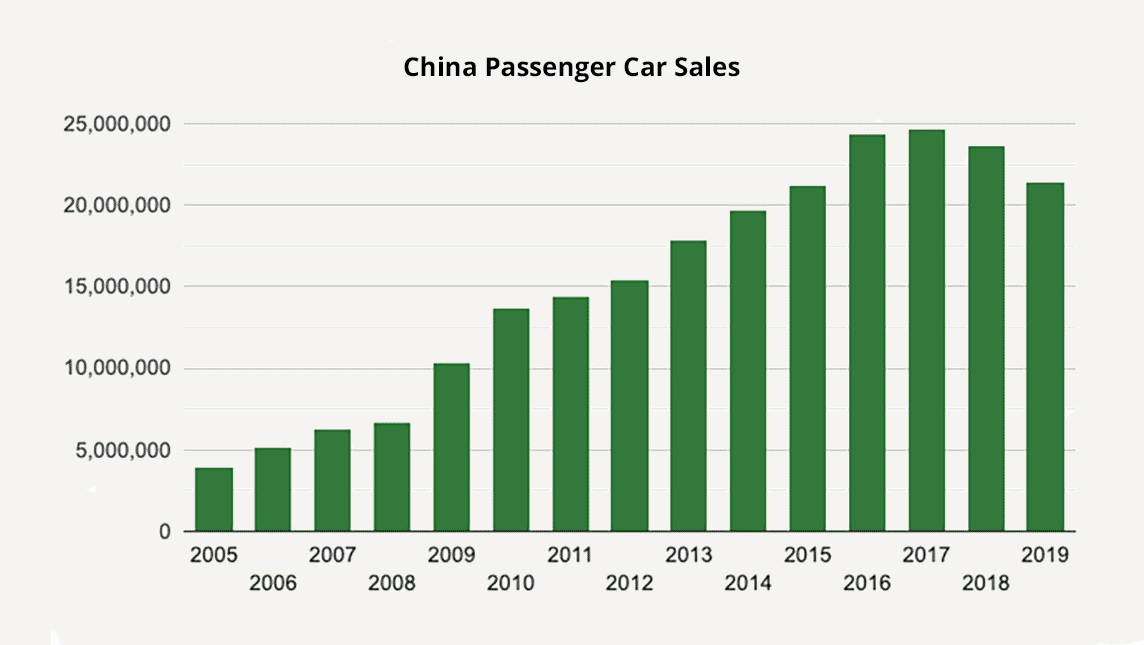

Despite a short-term slump, China remains by far the world’s largest automobile market with annual sales of more than 20 million cars. It overtook the U.S. in 2010. And despite the huge size, China’s car parc (meaning the number of vehicles in use) only showed that 173 out of 1,000 people own a car in the country. In contrast, the U.S. had a car parc of 837, Australia 747, and Malaysia 433.

In October 2019, McKinsey & Co released a 40-page report diving into car consumer behavior at every stage of the customer journey. They polled 2,500 respondents of varying demographics and vehicle purchase experience in 20 major Chinese cities, aiming to assess their attitudes to brand, choice of channels, product preference, price sensitivity, and after-sales behavior.

The report concluded that the current growth slump of vehicle sales is very likely to be a short-term market behavior and that there are strong indications of a continued growth trajectory, primarily led by the luxury, new-energy vehicle, and used car segments.

The report also concluded that a market rebound is likely to have several implications for automakers and other upstream participants as competition intensifies, narrowing the opportunities for weak and challenger brands. The implications include that understanding consumers and their segmentation as well as reshaping the brand experience by tailoring to specific consumer demands will be key to remaining competitive. Further, automobile companies must make better utilization of omnichannel while fixing the quality and safety pain points that usually come with buying a used car.

These all ring a lot of growth potential for Autohome to provide more value throughout the automotive value chain, gain more user engagement across their media platform, and thus increase their share of dealer sales and automaker advertising budgets.

The other side of the network – users and consumers – still has room to run as the middle class and per-capita income keeps growing immensely while internet penetration is highly likely to increase from its current level of about 65%. This is nothing new, but I bet you wouldn’t forgive me if I at least did not mention in a note on a business well-positioned to capture the growth in both trends.

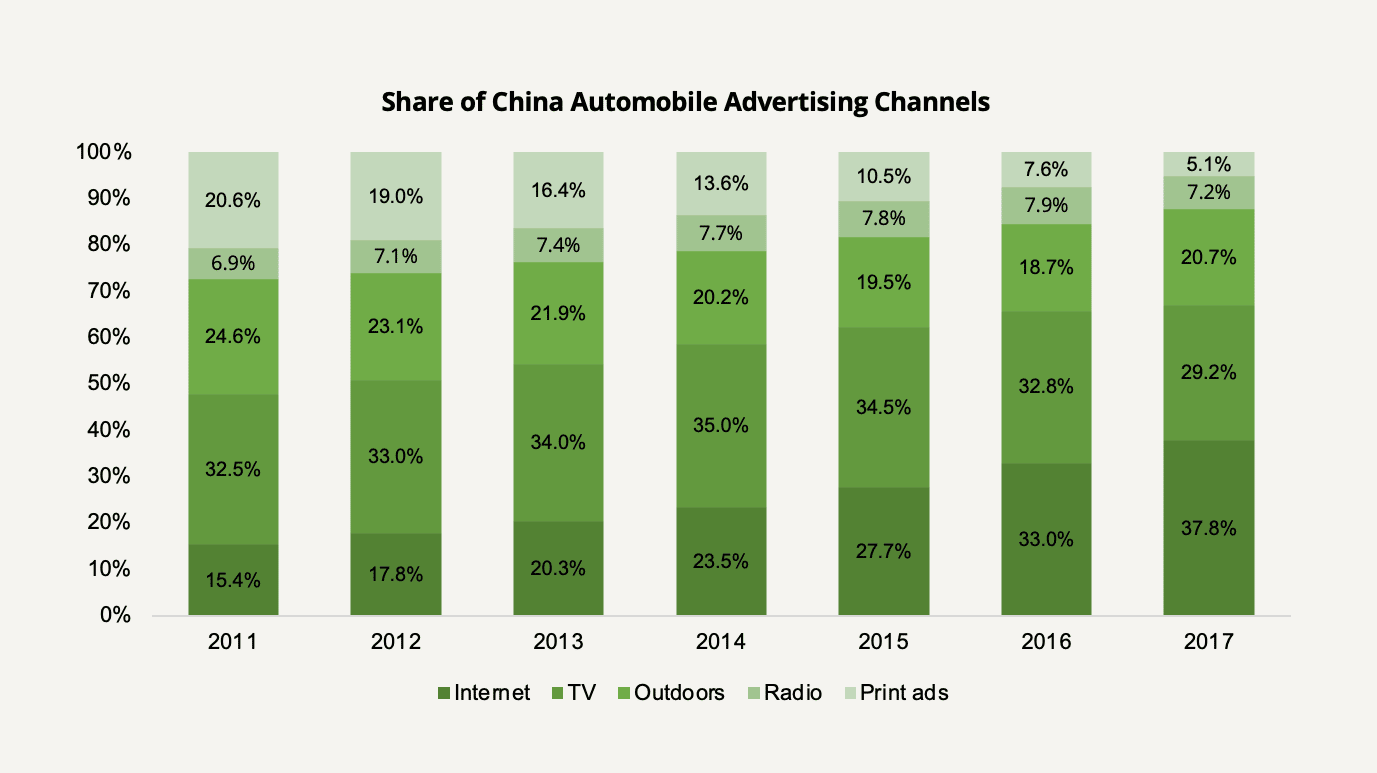

In line with the above, automobile advertising is (again not surprisingly and like pretty much every other industry) increasingly moving to internet platforms as opposed to traditional advertising channels, now making internet channels the most dominant in the automobile domain.

Prospects for Returns to Shareholders

On November 4, 2019, Autohome’s board of directors resolved to adopt a regular dividend policy in which the company will aim to return about 20% of earnings to shareholders going forward. While that is certainly in favor of the free cash flow hypothesis stating that companies that generate lots of free cash will be less disciplined with spending than companies with more legal obligations, it doesn’t really deplete Autohome’s growing cash pile.

The comforting fact is that companies that return less to shareholders than they have available in free cash flows are much more likely to be trusted with the cash if they have a track record of good investments. That certainly is the case with Autohome.

I think management may be unsure about its future financing needs and may choose to retain cash to take on unexpected investments or meet unanticipated needs. As far as I know, there are no acquisitions in the pipeline.

Speaking of management, Autohome’s majority shareholder, Yun Chen (a wholly-owned subsidiary of insurance giant Ping An) owns 51.9% of the company. Ping An is renowned for its conservative investment policy and Autohome’s conservative cash policy may be a testament to that. Autohome’s newly appointed Chairman and CEO, Quan Long, has served a series of leadership roles at Ping An since 1998, notably in property and casualty insurance gaining a comprehensive understanding of the automotive industry. His predecessor, Min Lu, has likewise served a series of executive roles at Ping An since 1997.

Another possibility is a buffer to act on share repurchases should management determine the share price to have reached undervalued territory. But here, it’s important to mention that Autohome is a Cayman-based holding company and its ability to pay dividends is primarily dependent on it receiving distributions of funds from the subsidiaries operating in China. Various company laws and foreign exchange regulations do not always make repatriating funds from China in a timely manner straightforward.

Conclusively, I don’t consider Autohome’s CNY14.2 billion excess cash pile an overwhelming problem – yet. A large part of it is clearly earmarked by further investments in innovation and strengthening the ecosystem. But as long as such efforts are fully financed by ongoing operations, the problem will inevitably loom larger. It’s going to be interesting to observe what management decides to do over the next couple of years.

Valuation

As always, for the last piece of the jigsaw, we will attempt to slap a value on our business in question.

Obviously, the determining factor for valuing Autohome properly is to make some sensible assumptions about the company’s growth prospects and returns on capital with both factors being largely determined by the capital allocation choices management faces in the future using its growing pile of cash.

In light of what we’ve discussed throughout this note, this is not an easy assessment. It’s an important one, but not easy.

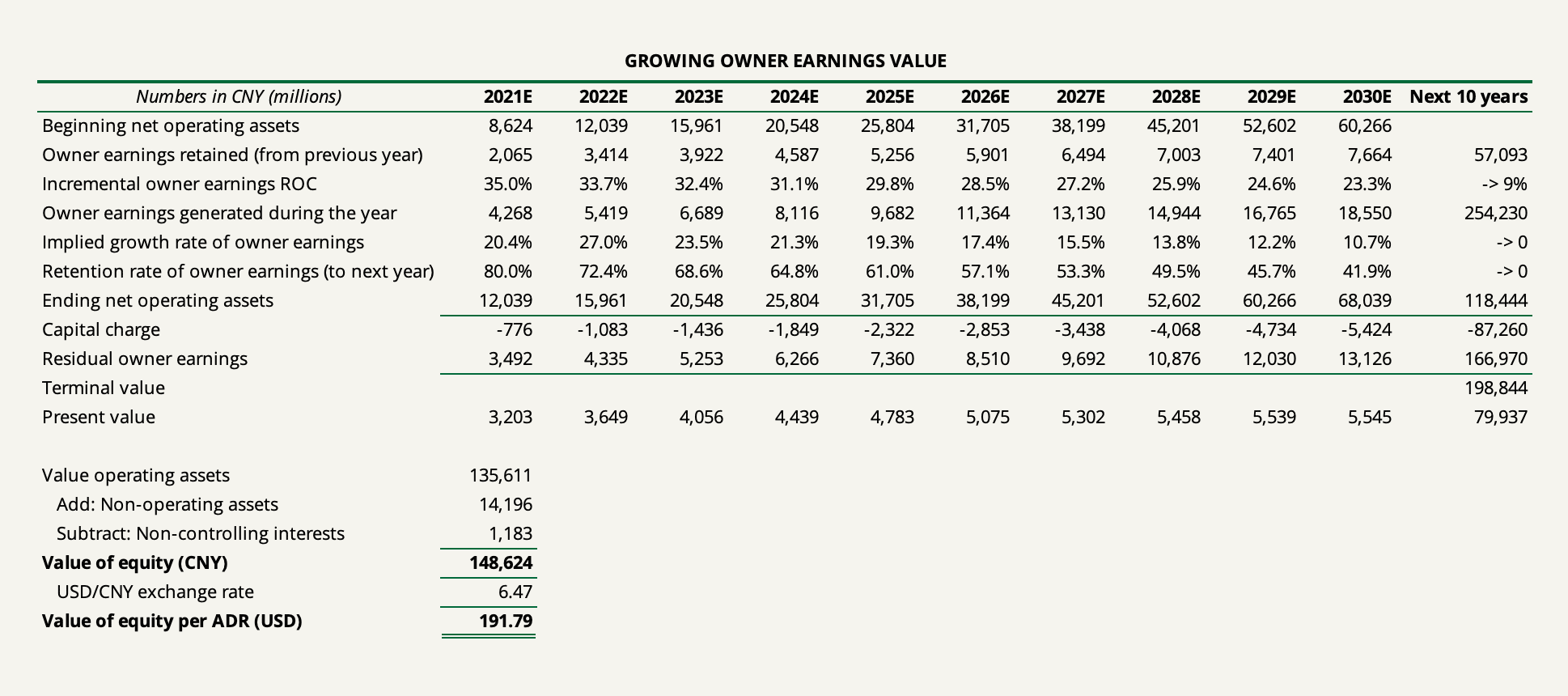

Therefore, in valuing the equity of Autohome, I would like to take a little different approach. I want to keep our focus on owner earnings rather than the traditional definition of free cash flow since the really important distinction here is the difference between growth capital expenditures and maintenance capital expenditures. And I want to keep our focus on the runway for Autohome to earn excess returns for many years to come without worrying about the exact timing for when the company might start returning capital to shareholders in a bigger way either as dividends or buybacks.

The way we do this is to build a very simple while conservative valuation model. We will start at Autohome’s current ratio of payout at 20% which we will gradually increase throughout the period in which we expect Autohome to earn excess returns. Likewise, we will gradually decrease the marginal returns on capital we expect the company to earn starting in year 1 to our required rate of return by the end of the excess return period until it reaches the state at which retaining capital provides no further value. The benefit of this method is that it forces our valuation to err on the conservative side.

For estimating owner earnings, we have a choice to make of whether we want to estimate it from a base of net income or NOPAT. Remember from our estimation of NOPAT that the difference between the two for Autohome is that NOPAT excludes interest income while net income includes it. If we start from NOPAT, we need to ultimately add non-operating assets to our estimated value and separate out non-controlling interests. In order to be consistent with our analysis of Autohome’s return on invested capital, this is what we’re going to do.

I would argue that the NOPAT figure we estimated for Autohome of CNY3,545 million in itself is a reliable estimate of our base owner earnings.

Here’s why.

The way we would calculate owner earnings is to first add depreciation and amortization charges, subtract maintenance capital expenditures, and then add or subtract the change in operating working capital.

For the maintenance capital expenditures, our best estimate would just be to assume that they equal the trailing twelve months’ depreciation and amortization charge. The reason is that property, plant, and equipment together with intangibles have shown to comprise a larger and larger part of revenues for the past five years and a conservative estimate (as in not risking setting too low a figure) would thus be the latest depreciation and amortization level. Hence, the net maintenance CapEx effect on owner earnings is a wash.

As for the change in working capital, the operating working capital has for the past 8 years on average been negative. We can therefore make a fair assumption that Autohome would not need to invest further in operating working capital and its effect on owner earnings is thus a wash.

For the excess return period, based on our knowledge about the company’s competitive advantage, I would venture to say that Autohome will be able to earn excess returns for at least 20 years from today. We can then let the expected growth rate be guided by our initial expectations about incremental returns on capital and the retention rate, both of which will gradually come down over time.

Our key inputs are:

- Abnormal return period: 20 years

- Base incremental return on capital: 35% (reflecting a higher invested capital base)

- Base owner earnings retention rate: 80%

- Base owner earnings level of CNY3,545 million which will grow to CNY4,268 million in 2021 based on the implied growth rate

- Required rate of return: 9%

By adding non-operating assets and subtracting non-controlling interest, we thus get an intrinsic value per share (ADR) of $191.79. By the time of writing this note, Autohome is priced at $129 per share which may suggest it undervalued. When we added the stock to the Junto investment portfolio in March 2020, the price stood at $64.16.

Nevertheless, please note that our method of valuation is rather simplified. If we were to change the excess return period to 15 years, the value per share would be $152.47 per share. Changing it to 25 years would compute a value of $240.88 per share from a bigger effect of compounding. The longer we stretch out the excess return and reinvestment period, the more stretched out the company’s growth trajectory will be.

But this is exactly the point. How are we to know exactly how long Autohome’s competitive advantage and excess returns will turn out sustainable? We can’t. For some companies with robust moats and a runway for growth, price doesn’t really make all that of a difference. Some companies can simply go on and ride a wave of compounding while the market struggles to appreciate the magnitude and longevity of the business’ fade-defying prospects.

Autohome has a good chance of being one of those companies.