Better Collective is a sports betting affiliate conglomerate capitalizing on the top-of-funnel acquisition game in a secularly exploding market that is online sports betting. Every month, 65mln visits span across a variety of websites owned by Better Collective to gather knowledge and tricks and what to bet, how to bet, and where to bet on all things sports, and to a lesser degree, online casinos.

You can think of Better Collective as a router for sportsbooks (or operators). As a user—your average sports fan, routined better, or regular gambler—browses one of Better Collective’s sites, they might click on a link to a sportsbook’s or casino operator’s website from a betting tip given by an expert tipster on one of the communities (e.g. bettingexpert.com) or through a static in-depth educational iGaming guide (e.g. roulettegeeks.com) that gives them insights into how they can improve their betting strategy. As the user activates the affiliate link and signs up with an operator, Better Collective earns either a fixed amount in affiliate commission or shares a portion of the sportsbook revenue generated by the player losses from the acquired customer for as long as the customer remains active with the operator. Essentially, once the user has signed up with the operator, Better Collective’s lead job is done and the money rakes in.

Why wouldn’t sportsbooks just vertically integrate and/or develop their own top-of-funnel content machines that could feed the sportsbooks with all these leads themselves, you ask? First, the affiliate model works partly because trust and brand value matter a lot, at least in the largest of Better Collective’s communities, and partly because the operators are perfectly happy to grow at a known CAC while trusting Better Collective’s use of on-site data that filters users based on intent, allowing them to receive better-qualified leads more efficiently (lower CAC and higher LTV) than they might be able to gather themselves. Operators are investing considerable amounts into marketing activities, many of which bring very volatile levels of efficiency. With affiliate marketing, the operator can calculate and compare the return on ad spend (ROAS) to the cent, thus getting a clear picture of the returns they get from a huge marketing budget. Moreover, it would take years or decades to reproduce a massive content library, and even then, there’s no assurance that organic search engines would favor their content to the incumbent affiliates.

“[The operators] have a bit of a love/hate relationship with us. They really want to market themselves to our segment. All the users who come to our sites, that’s their target group. At the same time, our consideration is the consumer and we compare odds, so we also help to create a kind of price competition.”

Jesper Søgaard, Co-founder and CEO

I remember learning about the affiliate model around 15 years ago and found it a fascinating way to create income and value out of written content that you could scale without dealing with physical products. One piece of content created in a few hours could theoretically generate income hundreds or thousands of times over, since, assuming it’s shareable and valuable to the user, anyone can access it while its popularity or age seniority gives it certain advantages in organic search positions and exposure on social platforms that can sometimes allow a flywheel to spin. I remember dabbling with creating a few sites in a few niches (protein powders and home security systems) at a time when every affiliate niche felt like being in the playground state. I earned a little pocket change but never stuck to it or doubled down on anything because affiliate marketing, while interesting, still just seemed and felt like a side hustle.

Well, the founders of Better Collective, Jesper Søgaard and Christian Kirk Rasmussen, stuck to it. A mutual interest in online casino strategies brought the two founders together during their time in high school where they became close friends. In 2002, after they graduated high school, they moved to Germany to enjoy a sabbatical year, and to pay the cost of living, they applied the casino strategies that worked at the time and set up a small hobby website explaining these strategies to Germans. The site attracted so few organic visitors that it generated no affiliate income for some time until Jesper and Christian started talking about their strategies to friends and strangers during the weekends. It was working but it was a slow grind. Two years went by, and the two friends come back to Denmark and finally set up a corporation for their business on year three—a year where their site had generated ~€19,000 in revenue. While they both attended University in Denmark, they continued to treat the affiliate business as their part-time hobby.

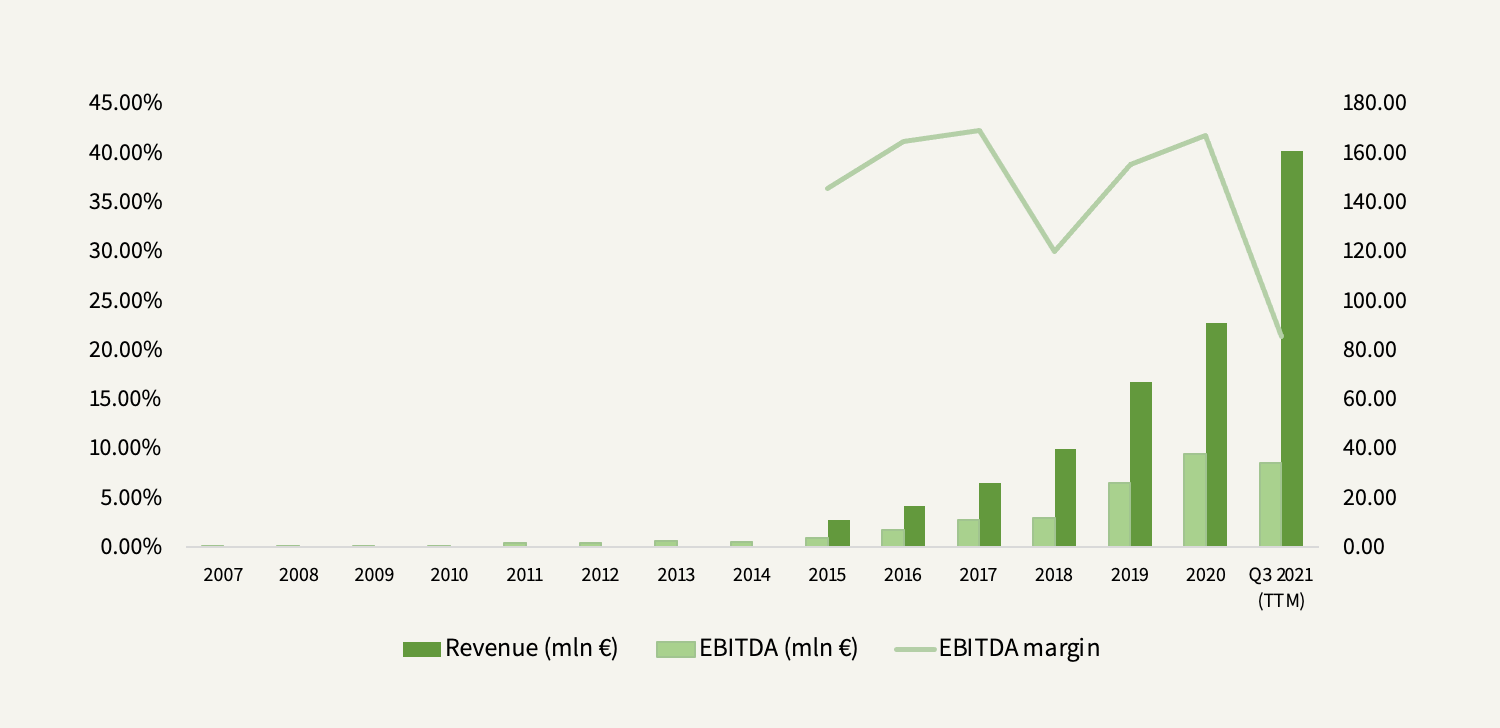

By 2006, the annual affiliate revenue had grown to €67,000, and as Jesper and Christian realized that the business could provide them both with a reasonable full-time income after completing their studies, it was also the year in which they decided to double down, spending about half of the year’s revenue taking ownership of Bettingxpert—today the company’s flagship product and the biggest social network for sports betting tipsters across the world—after which sports betting became its main focus. After that, it was a slow grind with geographical expansion and an acquisition here and there, and fast forward to today, the business has grown to a scale that the founders could not even have imagined. Today, Better Collective covers more than 30 languages with 700 employees spanning >25 countries, while the brands/sites, amounting to over 2,000, are highly tailored according to their specific regions and their respective regulations, sports, betting behaviors, user needs, and languages. Collectively, these sites have exploded to TTM revenues of €161 million.

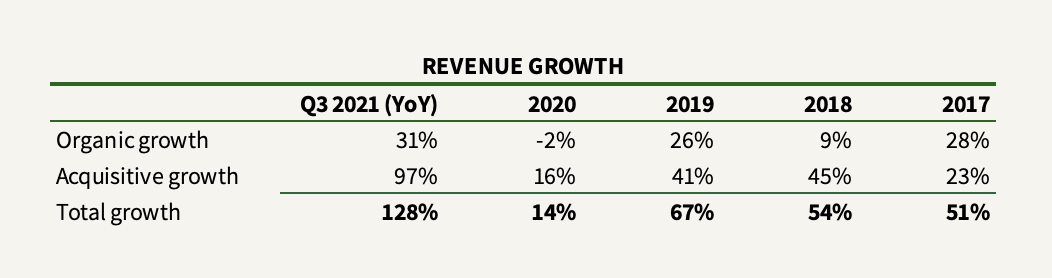

That one affiliate business got to such a huge global scale—into the largest sports betting affiliate in the world—while maintaining profitability in all years is a testament to, well, exceptional entrepreneurship, but also the entrenched viability of the affiliate business model and the ease with which it can cross borders. But note that the growth couldn’t have happened to the extent it has without firing up the M&A machine, which Better Collective did in 2017 right before the IPO that gave the company the right foundation to take on more ambitious targets.

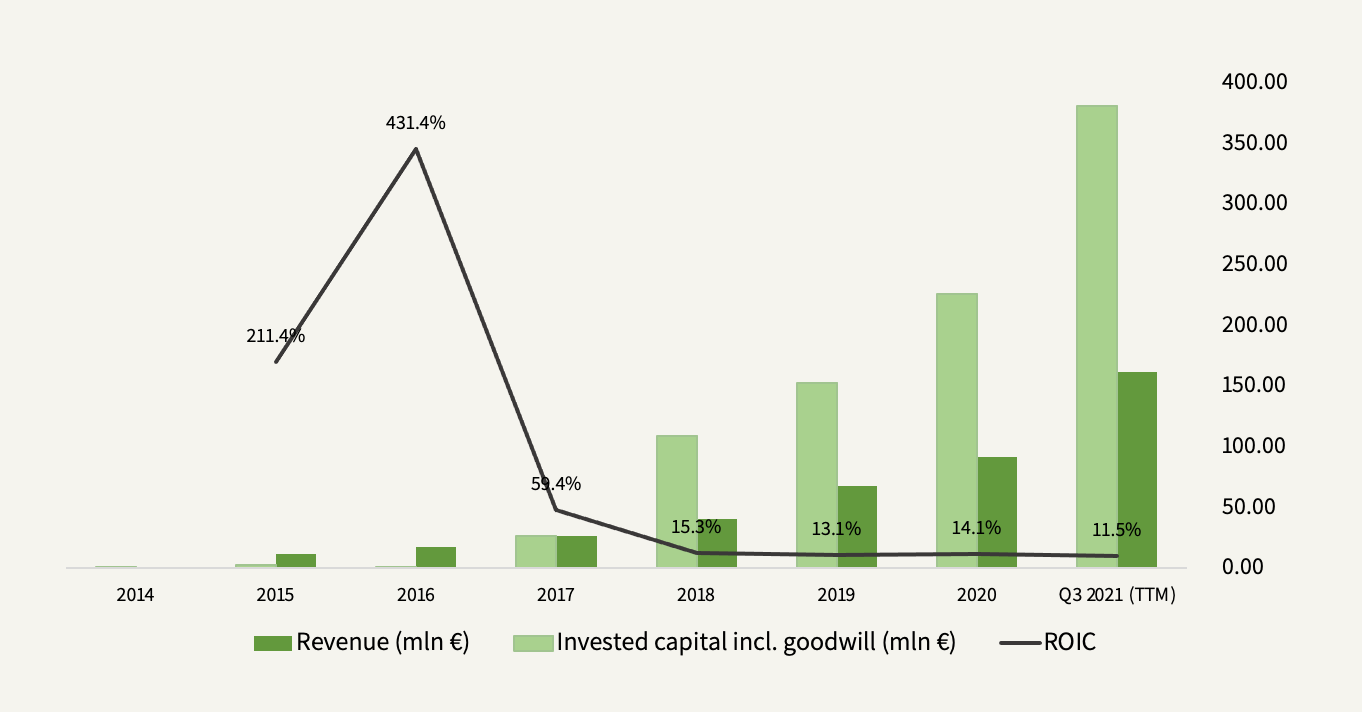

Since 2017, the company has scooped up 27 acquisitions of other affiliate sites and communities and management assures that the pipeline continues to be strong. But that doesn’t mean the acquisitive targets remain available at attractive prices. As M&A ramped up, returns on capital came down from the stratosphere.

You could argue that by buying Better Collective, instead of buying an excellent capital allocator, you buy the prospect of the company working its monetization magic to produce growth—in some cases rapid growth—once an acquisition target comes into the fold. So before we can judge the rationales behind management’s focus on acquisitive hypergrowth, it makes sense to first take a closer look at the iGaming market, the company’s strategic positioning, and the intentions with aggressively pushing into the acquisition space with what seemingly looks like loose price discipline.

As a relatively young and ambitious $75 billion industry (with about half comprising sports betting), iGaming (a catch-all word for online gambling and sports betting) has gone through five phases in its lifetime. First, there was the digitization of land-based betting to online betting. Then, there was a massive push to mobile which allowed the better to bet anytime, anywhere, and most importantly, live in-game even as they were watching the game on a stadium, fundamentally driving the sports betting TAM and engagement up. Then, as iGaming started to become increasingly popular, many countries began amending and implementing iGaming laws and regulations that allowed operators to set up onshore rather than on offshore locations like Malta or Cayman Islands, improving the visibility and leveling the playing field across the industry. As an extension of this improvement, sports turnover—the number of games to bet on—went up as idiosyncratic sports native to specific countries went into the pool. Finally, as a result of strict regulations and widespread popularity, responsible gambling came to the forefront to ensure industry sustainability (for instance, during 2020, some European countries implemented temporary restrictions in light of the pandemic with a view to limit harmful gambling in a stressful time).

All of which have turned iGaming into a highly attractive and open-ended growth market, one that some believe will chart like a hockey stick. Europe, Better Collective’s largest market, has the highest penetration of online sports betting in the world, growing annually in the mid to high single digits. But even here, sports betting is an emerging phenomenon and markets continue opening up and maturing. The largest economy, Germany, implemented a new regulatory framework last year, Der Glücksspielneuregulierungstaatsverag (GlüNeuRStV), a state treaty that legalized iGaming for all eligible operators, though with live sports betting limited to bets on the final score or the top scorers. In the Netherlands, where online gambling became fully regulated in October 2021, international operators are now given the opportunity to apply for a licence to operate. More than 20 operators are expected to be licensed by 2022, and according to the gaming consultancy firm H2 Gambling Capital, Dutch onshore iGaming is projected to increase from 22% of the country’s total iGaming in 2015 to 81% in 2024. As a result, the Dutch iGaming gross gaming revenue (GGR)—the amount the operator is winning and the customer is losing— is expected to reach more than €800mln in 2024, making it the fifth-largest iGaming market in Europe. With its recent acquisitions of Soccernews.nl and Voetbalwedden.net, Better Collective has entrenched a leading online media position with high affiliate growth expected from users that need to register with an operator at new if they had accounts with unlicensed operators prior to the regulation.

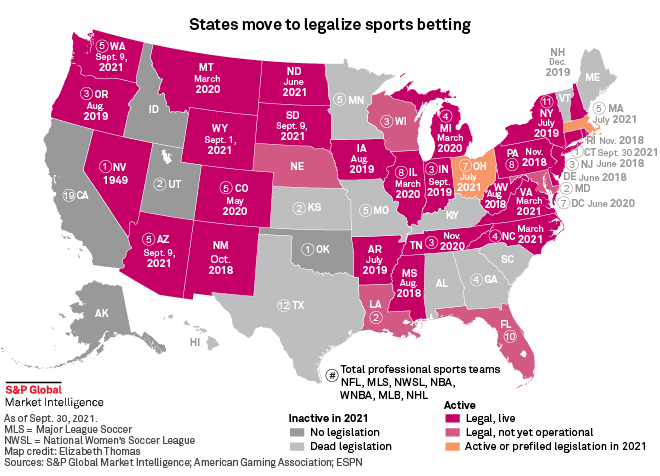

So it looks like Better Collective is facing an ever-expanding array of geographies and it’s, therefore, no wonder that it’s pushing aggressively to catch a dominant top-of-funnel position by acquiring online affiliate market leaders in each of these markets. But Europe is not where the vast majority of the TTM €222mln M&A spend as of Q3 2021 was funneled. Since the US saw the repeal of the PASPA Act in 2018, turning the legal status of online sports betting into a matter of state legislation, online sports betting in the country has virtually exploded. As an increasing number of states are expected to open up for regulation over the coming years, with the pandemic leading the shift in readiness and incentive to increase tax revenues, the US online sports betting market may surpass Europe in turnover in five to ten years.

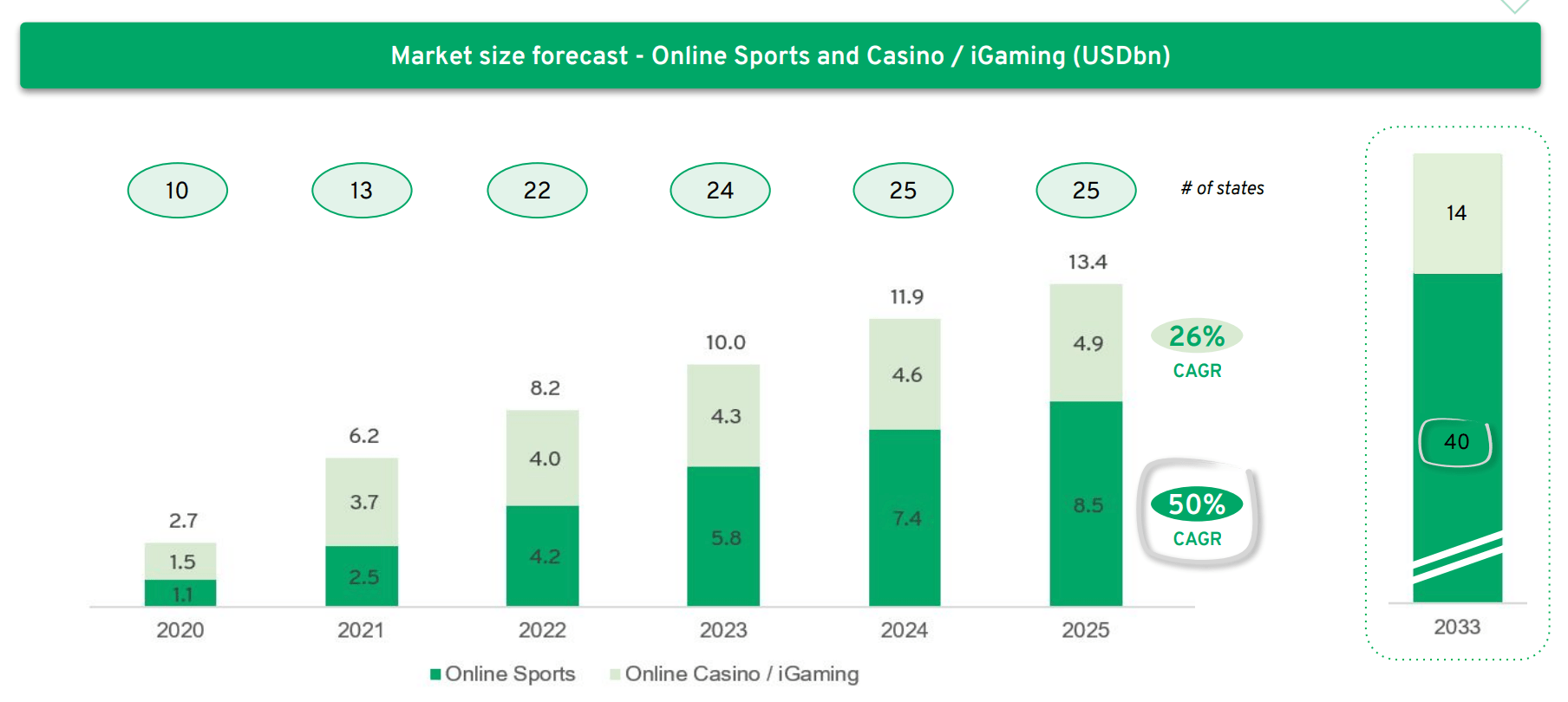

Even so, there are various variables at play (each state has different regulations, different operators, and often different views on individual sports), so it’s difficult to forecast the TAM of the US market. But considering that there are more types of sports in the US that people watch, including football, baseball, and basketball, whereas in other markets it might just be predominantly soccer, the propensity to gamble may not disappoint. Various growth estimates have been made by various sources, including Goldman Sachs which predicts a $39bln GGR online sports betting market by 2033 at maturity, based on a state-by-state prediction model taking account of share of spend and share of personal consumption expenditure. This is not something to glance over. Such a TAM would equate to a remarkable 40 percent CAGR over the next decade. To put that growth forecast in perspective, US e-commerce grew at an 18 percent CAGR over the past ten years with no individual category growing faster than 22 percent. Vixio expects the GGR to reach the $40bln mark even sooner in 2030, and, in line with Goldman, Better Collective itself expects a ~50% CAGR through 2025.

Keep in mind that prior to the PASPA Act, the US had a large gray sports betting market, primarily with offshore operators. So in a way, the legislation is really just tapping into an existing market but now you have the big catalyst from increased awareness and marketing that’s going to drive adoption over time. Almost none of the states opening up have licensing requirements for affiliate marketers.

So the US market brings huge numbers into play and Better Collective has been patiently waiting for it to happen. The company became a licensed vendor in New Jersey in 2014 and is currently live in 13 states, including Arizona, Colorado, Connecticut, Illinois, Indiana, Iowa, Michigan, Nevada, New Jersey, Pennsylvania, Tennessee, Virginia, and West Virginia, while launches in Washington D.C and Louisiana are in preparation. Other large states may join in a couple of years (the two largest by population, Texas and California, currently show no legislation). In New York, nine operators, including Caesars Sportsbook, DraftKings, FanDuel, and Rush Street, recently achieved sports betting licenses (however burdened with a significant 51% tax) and Better Collective has entered into partnership agreements with most of them through the Action Network subsidiary.

Better Collective acquired Action Network, a leading US sports betting media platform, in 2021 in a cash/stock deal for €196mln ($240mln), taking up the vast majority of the company’s M&A spend in 2021. The price equaled >5x 2021 expected sales, an expected 260% jump from 2020, for a company that grew ~100% from 2019 to 2020. Granted, this is a significant price tag but the deal also brought with it well-known brands such as Vegasinsider.com, a +20 years market-leading subscription and tip-selling website, RotoGrinders, the US leading fantasy sports site, ScoresandOdds, and SportsHandle. The more important part of the strategic move is that it allowed Better Collective to diversify into the subscription business through fantasy sports.

There are other strategic acquisitions worth mentioning. The Atemi Group, acquired at what seems a reasonable price in 2020 for €44mln (5.5x expected EBIT), is a specialized iGaming lead generator through paid media (PPC) and social media advertising that allowed Better Collective to partly diversify its user acquisition source away from organic search. After the acquisition, the company began reporting two operating segments, publishing (69% share of revenue, 40% EBITDA margin) and paid media (31% share of revenue, 9% EBITDA margin). HLTV.org, also acquired in 2020 for €34.5m (10x expected EBIT) is the leading esports platform in the world focusing on “Counter-Strike: Global Offensive (CS:GO)”. Mindway AI, acquired for a measly €2.8mln for 90% ownership, specializes in software solutions that aim to identify at-risk gambling and problem gambling behavior using machine learning.

In terms of amplifying the company’s competitive advantages in synergies and data, the company’s strategic acquisitions make sense. Once a target is acquired, Better Collective has APIs in place that allow it to seamlessly integrate with its unified platform. Unique data from the community sites are added to the target, traffic is driven from the target to the community sites, and all the data is collected in Better Collective’s BI framework which allows it to deliver better, higher-quality leads to sportsbook operators. This matters more than a lot. On the face of it, sportsbook operators are complicated, highly sophisticated tech companies that monetize algorithms that give the house an edge. But if you break them down to their unit economics, they’re playing the same game as everyone else: the game of CAC and LTV. So for operators, the game is best played by targeting customers who are likely to spend a lot of money on the sportsbook and acquire them as cheaply as possible. They get those at Better Collective. So as long as Better Collective keeps that advantage, it’ll remain an important part of the evolving sports betting universe.

But how strong is the moat around the data advantage, though, really? Other than indirect competition coming from other sports media empires like Barstool Sports, Penn National Gaming, or Score Stock Media, I wouldn’t count the risk from operators themselves out of the game because there is a risk that operators may try and cut intermediaries out over time. In some ways, you can see connections to what is happening in traditional media and cord cutting. Sports media companies are having a more difficult time both attracting younger consumers and keeping them engaged with sports going forward. Over time, you might see sports betting operators like DraftKings and FanDuel embed sports-media-type content directly into the app, circumventing many intermediaries, perhaps affiliates included. If, as according to Goldman Sachs, 50 million people in the US will be betting on sports at market saturation about a decade from now, and about 30% of the market is held by the top operators as it is now, that 15 million people is roughly the same number that watches NFL Football Sunday today, meaning their app could potentially circumvent the media intermediary and be the number one DTC channel for sports media. How is the affiliate market going to look in such a context? Will community betting tips move to where the action is? As the US market ascends, it’ll be land grab mode where operators try to acquire customers with very heavy promotions. And the way they’re doing that is not only through those promotions, but also by investing in technology heavily focused on in-game betting. I think it’s inevitable that the major operators, as their app user numbers run into the millions, over time will create mass content in-house (or compete with Better Collective in the M&A arena) and get closer to the top of the funnel, leveraging and monetizing content and sports betting together in a new revenue stream. So I guess what I’m saying is that Better Collective will likely keep its position as long as Google remains the gateway to the betting universe but that there’s a chance Google may not remain the main gateway. Perhaps Better Collective’s competitive advantages lie in the fact that sports betting is still at the opaque stage and that it capitalizes on making it more transparent. But sooner or later, sports betting may become as ubiquitous as sports fanship. Operators will turn more powerful when the vast majority of users are going directly to the app. Sooner or later, there’s the risk of Better Collective’s window being boiled down to simply comparing odds across sportsbooks. Better Collective got to make sure to own the top of the funnel in the meantime and reap the revenue share benefits.

I don’t know, maybe this is just overthinking, but perhaps you can tell that I don’t feel comfortable predicting much in the Better Collective story. Yes, the facts are right in front of us: a well-entrenched mid to high-single-digits-growing European sports betting market, an exploding US market, what seems like a good strategic position for Better Collective, capital-light operations with FCF funneled to growth, and well-oiled data and synergy advantages. Perhaps this market is all too dynamic for me to understand deeply enough. Perhaps I don’t understand the risks properly. Perhaps I’m wary of the faith one has to put in management’s (inexperienced) capital allocation skills considering the aggressiveness with which it’s buying into the market (which is somewhat mitigated, however, by the fact that the two founders collectively own 48% of the company). Whatever it is, something just keeps me from falling in love with the investment thesis.

Yes, the potential return seems alluring. Assuming no acquisitions, that everything goes according to plan, and taking management’s financial targets at face value, revenue will exceed €180mln for the full year of 2021, implying a growth rate of >100%. EBITDA will exceed €55mln with a combined margin of >30% with the publishing segment taking the organic lead. Then, assuming growth in conjunction with the sports betting market from which the emerging US market will take up 60% of revenues five years out (up from a current 22%), you could back into a total CAGR of 23% over the next 5 years to revenues of €507mln in the out year. Assuming a 30% EBITDA margin, 90% free cash flow conversion, 5% share dilution, and a 30x multiple on year 5 FCFE, you could pencil out a 26% annual return from the current stock price (SEK190) using today’s EUR/SEK rate. But that is assuming the best case which I’m not comfortable with. And then you’d also have to consider the reality that Better Collective is not stopping the M&A machine in any near future and that the increased risk-taking to grab share at potentially non-accretive prices is likely to be funded by further share dilution.