Put simply, my investment philosophy is to make concentrated investments in undervalued stocks of high-quality companies that I would prefer to hold forever (until better opportunities come along). I aim to compound the invested capital at rates of return that beat the S&P 500 and MSCI World Index net of taxes over the long run.

To understand how I think about the market and how I pursue to invest intelligently, the following reflects my investment philosophy and beliefs.

How I Approach the Market

I believe consistently excellent performance has to be achieved through extensive knowledge of companies and their securities. I am no market forecaster and I do not attempt to predict the direction of the economy, interest rates, or currencies. Therefore, my investment approach is entirely bottom-up, based on proprietary, company- and industry-specific research. I believe that a conservative, disciplined, and patient approach to buying significantly undervalued companies of high-quality businesses that are growing shareholder value is the best way to achieve my goal of compounding the capital at high rates over the long term with minimal risk.

Because I do not believe in the predictive ability required to correctly time markets, I do not attempt it, and I keep the Junto portfolio fully invested as long as attractively priced companies and assets are available in the market. This means that the equity asset share of my portfolio will never be determined on an ill-attempted guess of what the market will do in either direction. My asset allocation is based on my ability to find attractive investments in what the market has to offer me.

“If Mr. Market offers you the opportunity to buy assets at a deeply discounted price, that’s not market timing because you’re not trying to outsmart him.”

– Benjamin Graham

I view each portfolio investment as a 100% business owner would. When I buy stocks, I imagine that I’m purchasing the entire business while keeping the management in place, which allows me to think more about factors that impact the long-term value and earnings power of the company and less about things that impact the short term fluctuations in the stock price. I let volatility work to my advantage and I’m unconcerned about short-term selling pressures. I would be delighted to buy more of what I believe to be terrific stocks at cheaper prices.

Value Investing Is Intelligent Investing

In 1976, Stephen A. Ross wrote a research paper in which he introduced the famous Arbitrage Pricing Theory. In that paper, he argued that security returns are best explained by multiple factors and born was the term “factor investing”, which rapidly earned acceptance within academia, and most importantly, with bankers. And what usually happens in institutional finance; the more complicated things are to explain, the easier it is to earn fees from main street.

Ever since then, modern finance has identified the concept of value investing as being a factor strategy. This factor strategy is based on defining the company’s price attractiveness depending on simple key figures such as price-to-earnings and price-to-book multiples and thereby build a diversified portfolio based on a lot of these “cheap stocks”. The saying goes: shares with low P/Es are cheap and shares with high P/Es are expensive. On the contrary, a “growth” strategy is usually defined by buying popular high P/E stocks with price momentum, again through a diversified portfolio.

The problem with this definition is that it bypasses what actually does create value for cash-generating assets such as equities, which causes the value investing principle to fall to the ground, and which over the past many years has made value investing a misunderstood concept. I think that generally and widely known ratios such as yields, P/Es, P/Bs, or even growth rates have little to do with valuation – except to the extent that they provide clues in estimating the amount and timing of cash flows to and from the company at a specific point in time.

With that said, I do not believe that these conventional ratios are useless. They can act as very good boundaries for when one’s prediction about a company’s future is too aggressive, too conservative or too incomparable, but the numbers’ applicability usually stops there.

Compare what creates a stock’s value with that of a corporate bond where the formula for calculating the present value is essentially the same. In 1938, John Burr Williams defined the present value of a cash-generating asset as being any stock, bond or company’s future incoming and outgoing cash flows discounted at an appropriate rate of interest over the remaining life of the asset. Hence, both a stock and a bond consist of par value, cash flows to its holder, and an expiration date, while both assets derive their returns from the same source: the company’s (or other entity’s) cash flow generation. The main difference is that bonds pay out cash flows already known on the slip in the form of coupons and expiration date (unless, of course, a default occurs). In contrast, the future coupons of a stock must be subjectively determined by the stock investor, and the size and duration of these coupons have a much broader range of probabilities.

That is, the ability to estimate—with a certain probability—the normalized coupons that a company will create over a very long time is far more important than the actual growth, profitability, and volatility experienced by the company today. If the company can invest in growth without slackening a high return on invested capital, one cannot, with key ratios as a snapshot, assess whether the price of the business is too expensive or cheap at the given time. The best business is the one that over a long time can use large amounts of marginal capital to generate very high returns. The worst business is the one that, over a long time, needs to spend large amounts of marginal capital to generate very low or negative returns. The valuation task (and the intelligent investor’s job) is to assess this on a rational basis.

Thus, the best investment is always the cheapest one based on discounted cash flows, whether the company is growing or not, no matter how volatile the business is, or whether the company is trading at a high or low P/E. Growth and volatility are particularly often the dominant issues in the market and news headlines, where all growth usually is perceived as good growth. Unfortunately, many forms of growth do not generate attractive returns and can even destroy the present value of a company.

Bottom line: all intelligent investing is value investing. Concepts such as income investing, growth investing, momentum investing, and value investing are different sides of the same coin. Modern finance would do well by erasing this contrast and instead go back to Ben Graham’s savvy distinction between the intelligent [enterprising] investor and the speculator.

Defining Risk

One of the most difficult lines to draw in finance is the distinction between determinism and randomness (or skill vs luck). As investors, we need to always be conscious of the role of luck (and misfortune) which creeps into investing performance all the time. As the saying goes, probable things fail to happen and improbable things happen all the time. Investors are right (and wrong) all the time for the wrong reasons.

I agree with the fact that the correctness of a decision can’t be judged based on the outcome, but rather the validity of the reasoning behind the decision. When considering investment results, the actual return does not tell the whole story—the risk taken has to be assessed as well. And not just risk, but also the uncertainty of that risk.

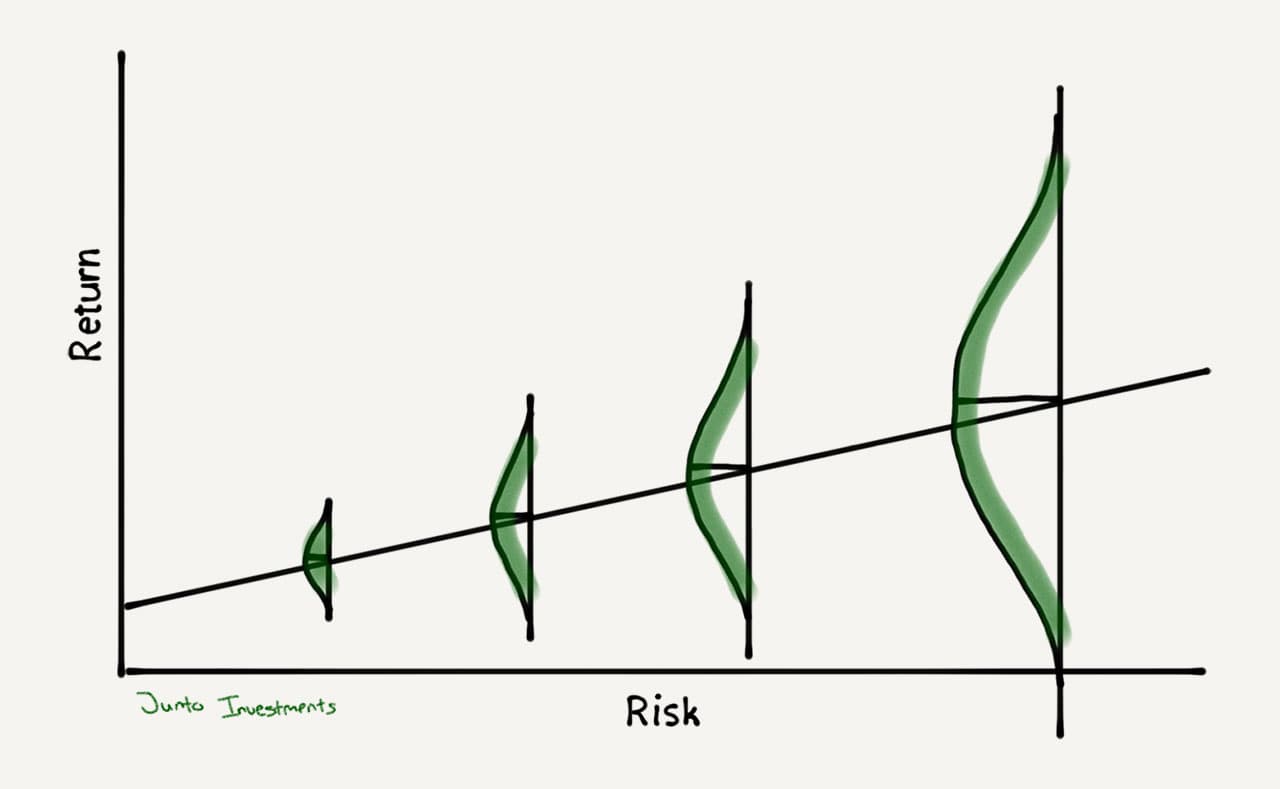

A ubiquitous observation in investing is that higher risk taken should be commensurate with a higher expected return. However, many have drawn the fallible conclusion that when things are going up, a higher risk always provides higher returns. That is a very fragile proposition since if this was the case the assets would not actually be riskier.

Investing involves dealing with the future, and thus risks and uncertainties are inescapable. In investing, one can never know the exact probabilities or distribution of potential future states. This is Richard Zeckhauser’s definition of uncertainty: When one doesn’t know any potential future states he refers to that as “ignorance”. In fact, the uncontrollable uncertainty element is probably a much more present phenomenon in real life than one tends to believe. Few activities in life involve true probabilistic “risk” (like gambling) as defined by Zeckhauser.

So the best one can do is try to rationally approximate the correct probability distribution and shape by thinking deeply about the problem. In doing so, one can go from full uncertainty to instead knowing and controlling risk, thus escaping Zeckhauser’s state of ignorance. But only by defining risk as it reflects reality can one aim to deal with it and approach the market with clarity.

The conventional way of describing and calculating risk is using price volatility compared to the general market through the greek letter beta. Through this definition, risk is described based on past price fluctuations and through the perspective of market prices. This is a notion that I do not accept. I define risk as stemming from the risk of permanent loss of capital or achieving an inadequate return on the capital. I do not view temporary drops in prices as a real risk of doing business, and modern portfolio theory or beta is not something I think about at Junto.

“Volatility is an overworked concept. You shouldn’t be imprisoned by volatility.”

– Charlie Munger

I aim to control risk by taking the mispriced bets and I do not attempt to do better than the market when I experience no real opportunities. And because we humans usually overestimate our ability to gauge risk and extend to what we think we know, I aim to purchase assets with an adequate margin of safety. In fact, I view this as the only sensible way to achieve excellent risk-adjusted returns in the long run.

The market is a pari-mutuel system where the odds are set by other market participants at times from very favorable conditions to not favorable at all. This is when the market swings from being inefficient to being efficient at different points in time.

At times when everyone believes something is risky, their unwillingness to buy usually reduces the price to the point where the asset is not risky at all. These mispriced odds are where the biggest opportunities are. On the contrary, when everyone thinks an asset embodies no risk, the price is usually bid up to a point where it’s enormously risky. Most market participants think quality, and not the price, is the determinant of whether something’s risky. However, the reality of the pari-mutuel system is that fundamentally weak assets can make for a very successful investment if bought at a low-enough price.

While recognizing that buying below intrinsic value is the way to minimize investment risk, I am always aware that risk mitigation still entails uncertainty, and investing rationally is sometimes not equal to a favorable result. One only experiences one alternative history at a time and only the things that happen, happen. This is the nature of doing business and it’s the reason why I’m a very long-term investor. Uncertainty and the role of luck tend to even out over time.

“Trying to buy below value isn’t infallible, but it’s the best chance we have.”

– Howard Marks

Finding the greatest value investing opportunities usually involves buying when prices are falling. Thus, when buying stocks, albeit at an attractive price, I’m fully aware of the natural possibility that I may suffer periods of underperformance in the months and possibly years immediately following my purchase. I always invest imagining that the stock exchanges will be closed for the next five years.

The Art of Being Unreasonable

In my quest for making intelligent investments, I invest unreasonably. I look for real bargains and exceptional opportunities. To do this right, it requires that I apply strong discipline, patience, and aversion to activity.

All of my potential investment ideas are ranked based on attractiveness in relation to each other and I invest intending to minimize my opportunity cost. The attractiveness of the alternatives I have determines the hurdle rate that each investment idea must surpass. Thus, I always ask whether I would rather increase the proportion of the portfolio’s current holdings than buy the new investment idea. If I have one idea that is better than 98% of other alternatives, the other 98% are removed as potential investments. It’s a very simple idea and intrinsic yardstick. Additionally, the emphasis on opportunity cost involves trading very infrequently and having a low portfolio turnover, thus earning the potential for additional compound returns on fees and tax savings over many years.

Relative market efficiency makes big edges rare, so I’m willing to bet big when the right opportunities come along. That is why I have no maximum percentage allocation set for any holding which naturally makes me a focus investor. I make little regard as to how diversified my portfolio is. I find the idea of diversifying to achieve excellent returns an impossible task. Instead, I try to find places where it’s safe and wise not to diversify.

“For individuals, any holding of over twenty different stocks is a sign of financial incompetence”

– Phil Fisher

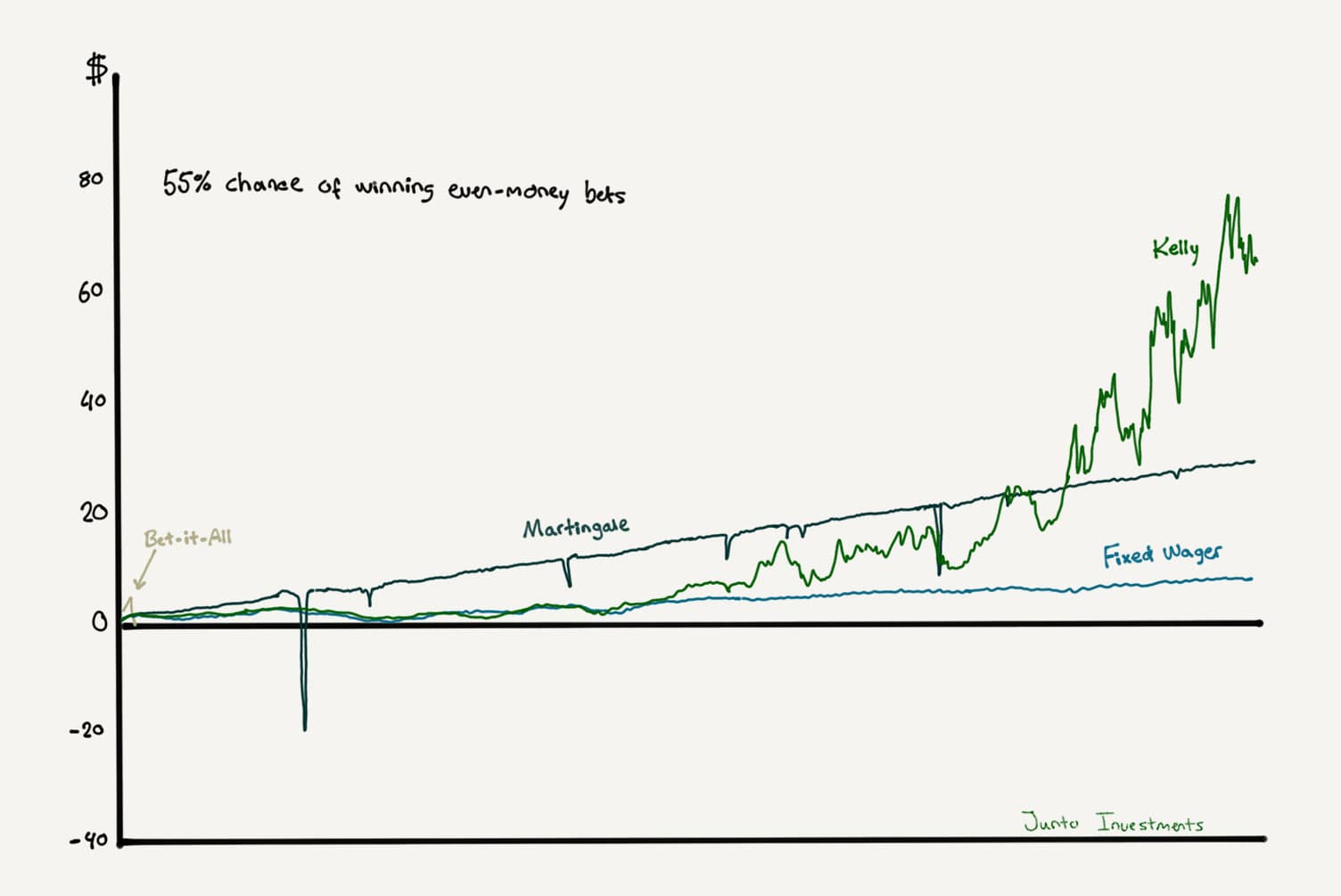

In 1956, a young scientist at Bell Labs named John Larry Kelly Jr. came up with a beautifully simple equation today known as the Kelly criterion (or Kelly betting system), basically based on Claude Shannon’s information theory and Bernoulli’s St. Petersburg Paradox. The Kelly criterion is a formula for bet sizing that leads almost surely to higher wealth compared to any other strategy in the long run. Its history and practical application have been wonderfully and humorously described in William Poundstone’s book, Fortune’s Formula.

According to the Kelly criterion, the optimal fraction of your bankroll to allocate to a favorable bet is:

Edge / odds = Fraction of your bankroll to bet each time

As an example, taking a positive risk/reward bet of 1:2 with a 50% chance of either outcome, the Kelly criterion suggests that the optimal bet size of the bankroll is 25% (reward if positive odds play out is 2 and edge is 0.5, so 0.5 / 2 = 25%). No other approach can increase wealth faster than the Kelly criterion without increasing the odds of wiping out the bankroll.

Four Money Management Systems

Considering the hard work and effort required to find and seize great opportunities, I frankly find it irresponsible not to apply the principles of the Kelly criterion when such opportunities pop up. I think that the attempt to dilute a portfolio with more names in mindlessly equal installments is a mad way to behave when actively managing capital. Many investors, including most professional money managers, own too many stocks, ignoring the boundaries of their mental capacity, resulting in excessive mistakes and harmful frictional costs.

Since waiting for the great opportunities above my hurdle rate often involves waiting a very long time, I’m careful not to relax my investment standards after a drought of ideas. I shall be able to sit still without tiring of sitting still.

To allow for instances where I’m very off on probabilities, I apply a margin of safety to the Kelly criterion. Thus, my aim with using the principle is to be dictated by the upper bounds of the criterion so as to never exceed what turns out to be the true optimal betting size. This simply rules out using leverage. Additionally, every decision I make must be based on buying in terms of my rational perception of probabilities and having a very long view in order to reap the Kelly criterion’s rewards.

Focus investing almost surely entails a more bumpy ride and lumpy returns, but volatility in my returns is not how I measure performance. I let investments tell me their performance by the operating results. The same idea applies to a manager in a business investing capital where some business opportunities require being willing to have volatile earnings. Why would investing in stocks be any different when what we invest in are businesses?

Inversion

To earn superior returns, one has to deviate from herd behavior and mimicking of other market participants. Therefore, good investing is inherently contrarian, but only when it makes sense to be so. It’s not about always being a contrarian but being an intelligent contrarian only when an opportunity exists that be taken advantage of. Buying stocks just because they seem low is not a prudent way to behave.

To be an intelligent contrarian in a field where the general IQ of the other market participants is above average does not just require being smarter than that average. In fact, I view that as being very unnecessary. Although being smart helps, the most important qualities are rationality, emotional stability, and being able to think independently.

To think independently about how I conduct my business, a mental model that I think hard about when solving investing problems is inverting them. This allows me to often arrive at a sound conclusion faster and more efficiently while aiming to avoid stupidity. Inverting investing problems won’t always solve the problem I’m looking at, but it helps me avoid trouble. So before I analyze and try to understand a company’s current and future success, I look to understand what could potentially destroy the business.

“All I want to know is where I’m going to die, so I’ll never go there.”

– Charlie Munger

Inverting is the best way to allow me to think for myself and avoid the noise in the news and market. This means that I take good care of what information I consume to gather ideas—what I call my “Information Spectrum”. This includes studying quality material, preferably from first-order sources, such as annual reports and SEC filings, industry reports, trade journals, newspapers, and an extensive amount of books to expand knowledge and creative thinking. I avoid reading analyst reports or anything of the sort. I read very little of it and never rely on it. Relying on others’ analysis results in paralysis or panic under volatile conditions.

A closely related mental model to inverting, and a necessary element to achieve success with long-term investing, is second-level thinking.

I do not have any informational advantage over the market, nor do I think I need one. I do not believe that one has to know something the market doesn’t in order to achieve superior returns. When researching stocks, analysts, like myself, all use the same data when doing a valuation and many smart analysts make very good estimates on where those numbers are likely to end up.

Instead, the advantage one can gain involves thinking differently about the information at the second level. While most market participants focus on the next year or 2-3 years out, second-level thinking involves visualizing how reality will look over a very long time and look to where no one else is looking. Conventional first-order thinking is fast and easy and everyone often reaches the same conclusion. Second-order thinking is deep and deliberate requiring thinking in terms of decision trees, systems, and time. This is where the greatest edges appear.

“The typical hammer-wielding Wall Street analyst is fixated on the next few quarters, not the next half-century when trying to figure out any given company.”

– Mohnish Pabrai

Multidisciplinarity

So far, I have mentioned a few mental models and systems (such as opportunity costs, the pari-mutuel system, Mr. Market, the Kelly criterion, etc.) that I use to understand and connect signals and ideas. For me to interact with the world more effectively, I view knowledge as a semantic tree on which to hang on the information that I take in. These mental models and systems help me visualize that tree, learn much faster, and aid me in becoming more polymathic.

Because investing is such a complex and intellectual game, it is impossible to understand the important phenomena that are affecting circumstances today from the perspective of any single incomplete system of thought. Although this accomplished and crucial fact is widely recognized, it, unfortunately, is not as widely practiced in the financial industry. Disciplines develop their internal ways of looking at the phenomena that interest them, and when an entire industry operates in such a state, it quickly allows for dangerous behavior such as; herding, reinforcement of preconceptions, consensus-seeking, incentive-caused bias, and suppression of critical thinking. A business school degree does not teach one how to mitigate these effects.

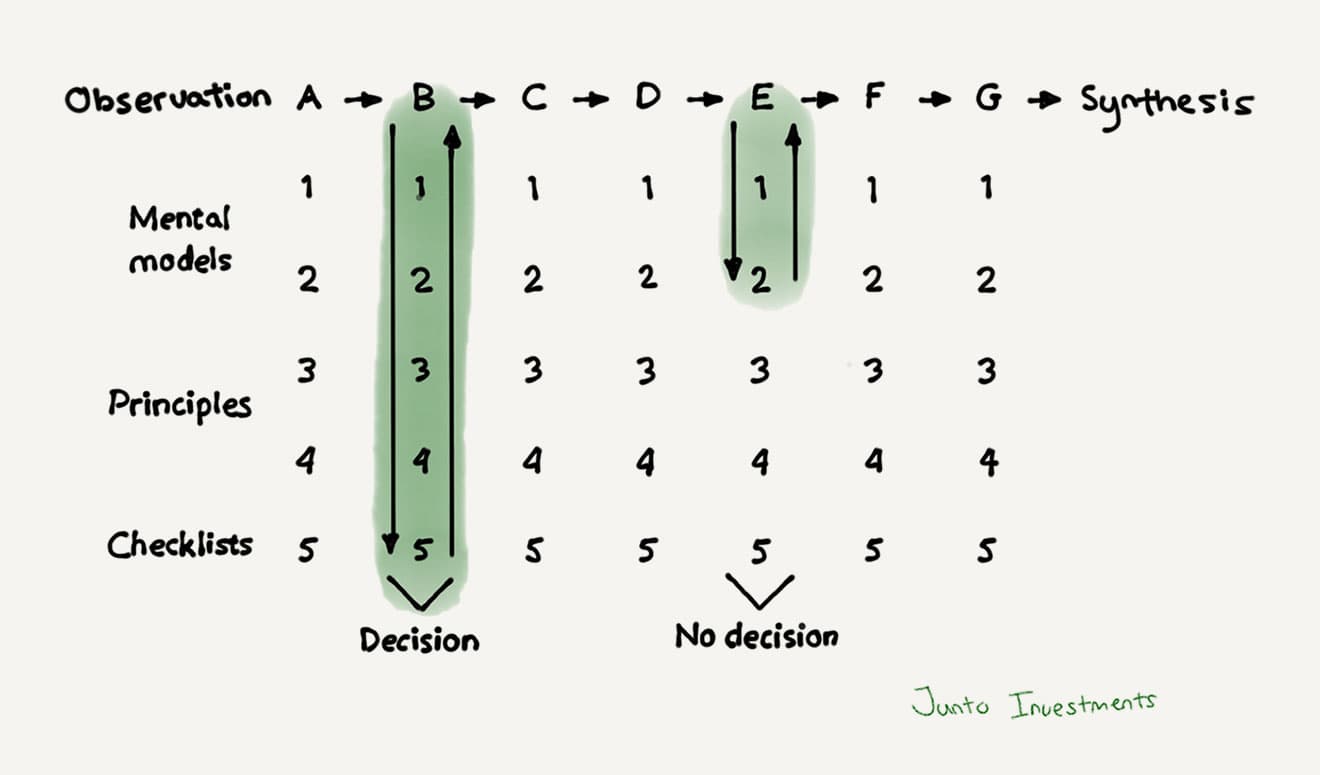

Therefore, for me to gain psychological discipline, I use a framework for thinking about problems in a rational way and a system that allows me to keep my emotions from corroding that framework. This framework is built based on knowledge from a wide range of disciplines with economics, psychology, and history being at the forefront.

“He who sees the past as surprise-free is bound to have a future full of surprises.”

– Amos Tversky

One of the leading contributors to the field of behavioral economics is Robert B. Cialdini who is best known for his book on persuasion and marketing, Influence: The Psychology of Persuasion. Although Cialdini has spent his life studying business and psychology, he admits often being subject to the same human biases he writes about. It goes to show how powerful human biases are wired into human behavior through thousands of years’ evolution. Hence, I have designed my decision framework in a way that best prevents me from being subject to error-causing psychological tendencies.

This framework is built upon mental models, principles, and checklists. I call it the “Decision Levels” framework. This is not a rigid system. It’s simply a way to think about optimal decisions, and there are situations when the framework can’t be applied directly. It’s not always directly applicable to all situations, but it should work brilliantly when it is.

The Decision Levels Framework

For a full walk-through of my Decision Levels framework, read my complete guide to decision making.

A wide interest and curiosity about the world from all perspectives and fields such as philosophy, economics, psychology, mathematics, physics, biology, and history gives one an enormous advance in the quest for making intelligent investment decisions. That is why I not only study and write about companies and financial data, but practically everything that allows one to expand one’s knowledge and ability to make sound investments in the markets, one’s relationships, and in life.