One of the most important mental models I learned as an investor came from Richard Zeckhauser, Professor of Political Economy at the Kennedy School at Harvard University.

The good thing about studying Zeckhauser’s work is that it sticks very easily. While scientific of nature, the main ideas are simple and broadly applicable in your life. And as simple as they are, as important they are too.

Here’s proof of why this knowledge is important to you. Charlie Munger once said the following about Zeckhauser:

The right way to think is the way [Harvard Professor Richard] Zeckhauser plays bridge. It’s just that simple.

***

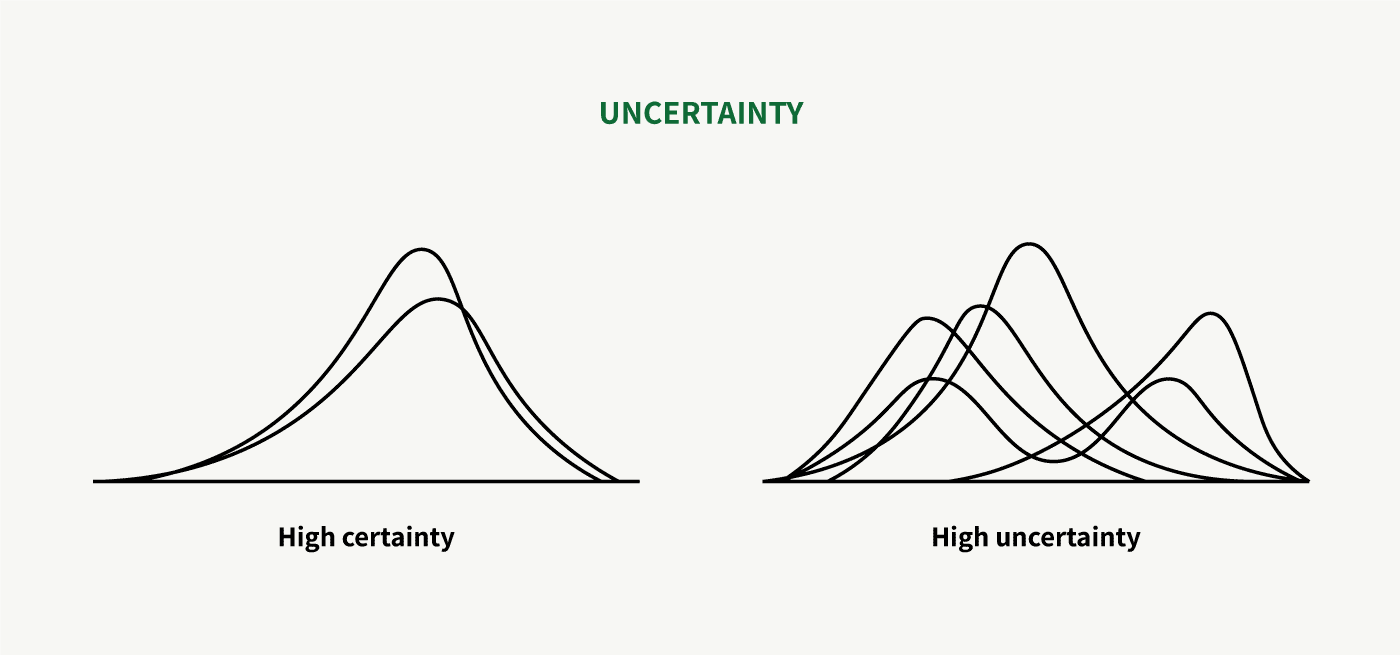

Many confuse risk and uncertainty as being the same thing. But Zeckhauser argues that they are two different domains. In life, you actually rarely deal with situations that are purely risky.

I illustrated the difference between risk and uncertainty in my last article using probability distributions. These illustrations are once again relevant to this discussion.

Risk is what you encounter at the roulette wheel. It’s where you know the exact probabilities of outcomes, and you know them at every spin. But almost any aspect of life does not operate that way. Almost any outcome lies somewhere on the spectrum between the illustration for risk and the illustration for uncertainty.

Casinos, which rely on dice, cards and mechanical devices, and insurance companies, blessed with vast stockpiles of data, have good reason to think about risk. Most of us have to worry about risk only if we are foolish enough to dally at those casinos or to buy lottery cards.

Therefore, dealing with uncertainty is much more important than dealing with risk. You can manage your way around risk, but not uncertainty. What you can do is turn uncertainty into risk, which we’ll turn back to later.

Uncertainty, not risk, is the difficulty regularly before us. That is, we can identify the states of the world, but not their probabilities.

[…] We should now understand that many phenomena that were often defined as involving risk – notably those in the financial sphere before 2008 – actually involve uncertainty.

Think of risk as when you have ‘known knowns’ and uncertainty is when you have ‘known unknowns’.

But risk and uncertainty are not the only domains. Zeckhauser also defines a third domain that you cannot turn into risk. For this, he uses the term ‘ignorance’. You can think of this as another name for the ‘unknown unknowns’ of the world.

Ignorance arises in a situation where some potential states of the world cannot be identified. [It] is an important phenomenon, I would argue, ranking alongside uncertainty and above risk. Ignorance achieves its importance, not only by being widespread, but also by involving outcomes of great consequence.

‘Ignorance’ is such a nice term because it describes the things you didn’t even know you needed to find out—things like geopolitical events, financial blowups, or climate disasters. So unlike risk and uncertainty, ignorance is not something you can slap a model on.

Just as traditional finance theory hits the wall when it encounters uncertainty, modern decision theory hits the wall when addressing the world of ignorance.

And the tragedy of ignorance is that the events that often have the biggest impact on what you do are often part of the ignorance domain.

Let’s dive a little more into uncertainty and ignorance. Because not only does the presence of these domains present challenges to the investor but also opportunities.

The first positive conclusion is that unknowable situations have been and will be associated with remarkably powerful investment returns. The second positive conclusion is that there are systematic ways to think about unknowable situations. If these ways are followed, they can provide a path to extraordinary expected investment returns. To be sure, some substantial losses are inevitable, and some will be blameworthy after the fact. But the net expected results, even after allowing for risk aversion, will be strongly positive.

An unknown future is not predictable. But what you can do is prepare.

Portfolio theory built on assumed normal distributions is a beautiful edifice, but in the real financial world, tails are much fatter than normality would predict. And when future prices depend on the choices of millions of human beings and on the way those humans respond to current prices and recent price movements, we are no longer in the land of martingales protected from contagions of irrationality. Herd behavior, with occasional stampedes, outperforms Brownian motion in explaining important price movements.

If you automatically think in terms of normal distributions and Brownian motion when studying financial markets, you use the wrong mental models. Rely on history, not on academic models built on the wrong assumptions. Powered by speed and innovation, things that according to academic models should only happen once every hundred or thousand years happen through shorter and shorter time spans. It’s the same thing with company life spans. And each cause is distinctive; The next crisis is going to be quite different from the past one.

Because markets are complex adaptive systems, this complexity doesn’t lend itself to tidy mathematics. Rather, it lends itself to more black swans than you might imagine.

This means two things.

First, major investing mistakes occur at the extremes, whether it’s when the market is in panic or at a euphoric high. It’s the preparation for the extremes that enables you to navigate ignorance.

Second, you need to accept the unknown. Only by accepting the unknown can you act logically when it’s most needed. Crises are inevitable and you should not underestimate the shaking of your rationality when they arrive. Ignoring the unknown invites ever more ignorance. In the words of Nassim Taleb, if you tend to mistake the unknown for the nonexistent, you become an empty suit.

Most investors—whose training, if any, fits a world where states and probabilities are assumed known—have little idea of how to deal with the unknowable. When they recognize its presence, they tend to steer clear, often to protect themselves from sniping by others. But for all but the simplest investments, entanglement is inevitable – and when investors do get entangled they tend to make significant errors.

When you internalize Zeckhauser’s mental model of what is risky, what is uncertain, and what is ignorance, you begin to appreciate how difficult it is to forecast literally anything and that there’s a vast difference between what you can predict and what you can’t predict.

How to Deal With Ignorance

You can’t deal with ignorance if you can’t recognize its presence. But you can prepare for it by recognizing that it’s there and acting rationally when it’s most needed.

So once you recognize that you’re in a state of ignorance (e.g. when you try to predict another pandemic or war, or when exactly the next financial crisis will come), you should change the way you think about the world and the situation at hand.

We can’t prevent the most likely next financial crisis by telling banks they need to keep an extra billion dollars or so in reserves. Instead, we should always be scanning the horizon for new risks.

[…] Once we recognize this, we could go to a situation where the expected magnitude of what we lose drops from 100 to 50, and the likelihood of a crisis goes from 1% to 0.5%. But crises will still occur, and when one does, we’re still going to lose 50. If we could cut the likelihood and severity of auto accidents in half, we could cut auto fatalities by perhaps 75%. Not perfect, but very welcome. Preventing financial crises is not possible. Cutting their likelihood and severity would greatly benefit the world.

How to Deal With Uncertainty

Compared to ignorance, our hopes are better with uncertainty. Because not only can you recognize uncertainty, you can also mitigate it or even remove it.

Your first step is to figure out whether you are actually dealing with a problem that belongs to the domain of uncertainty or if it’s in fact ignorance. And the way to do that is by looking at the complexity of the system in which you are operating.

The more complex the system, the bigger the chance you are dealing with ignorance. In the investing discipline, you find less complexity as you move from macro to micro. And you again find less complexity in the micro as you move from global conglomerates to local, simple businesses.

The investor’s time is better spent trying to gain a knowledge advantage regarding ‘the knowable’: industries, companies and securities. The more micro your focus, the great the likelihood you can learn things others don’t.

—Howard Marks

Once you’re in a state of knowledge about the unknowns of the problem, you can begin chipping away at uncertainty by learning about these unknowns until you are at a place where you can effectively assess the risk. And the way to do that is to learn more about what you don’t know.

The essence of effective investment is to select assets that will fare well when future states of the world become known.

[…] “Practice improves decision performance. Awareness of problems improves decision performance.

In investing, the unknown is your friend. If everything was known to everyone, you wouldn’t find a single mispriced bet offering you exceptional returns. As you mitigate uncertainty, thus knowing more about the potential range of future outcomes than the other market participant, you will have an advantage in the stock market’s pari-mutuel system.

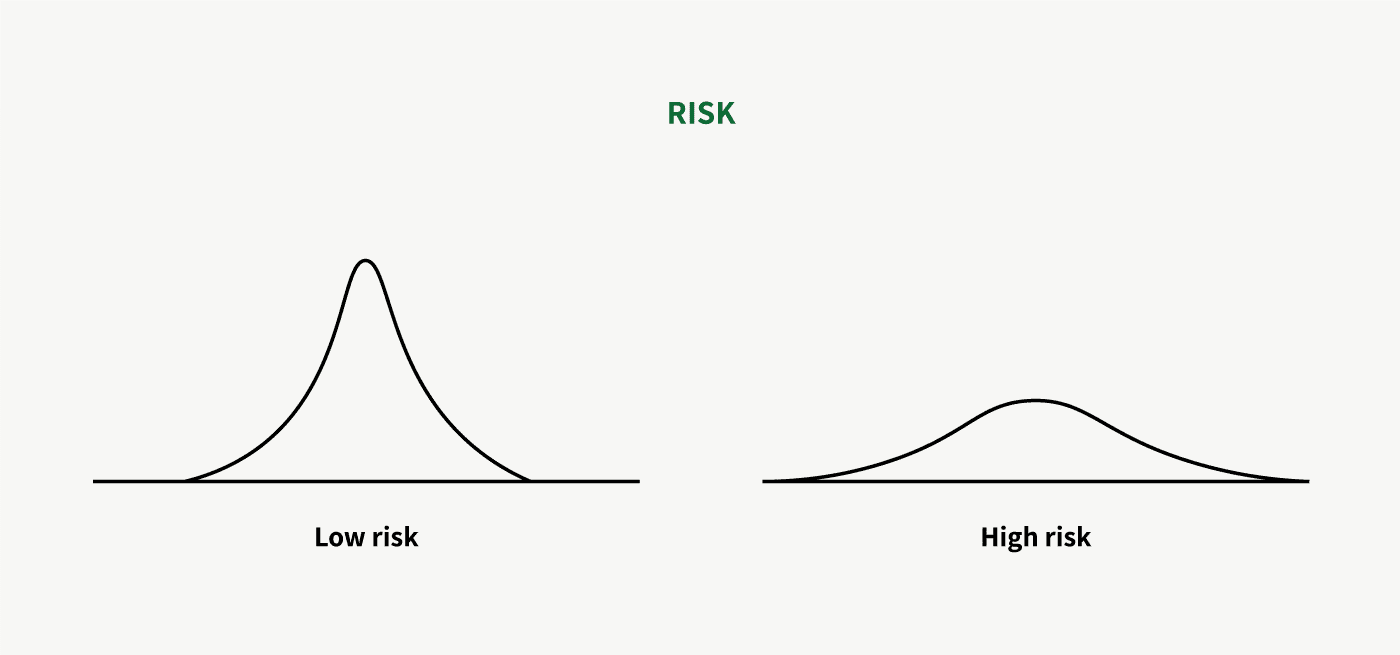

How to Deal With Risk

The last domain is the easiest to deal with and therefore the least important. Risk is when you may not know the exact outcome, but you know the probability distribution.

Risk is entirely manageable once you know the probability distribution. At the roulette wheel, you have a very easy financial decision problem. You know you’ll never have an edge over the house, so you don’t play the game.

Investing is the same thing, except that the element of uncertainty inherent in investing problems may cloud your judgment. If you could hypothetically remove all uncertainty from the investing problem leaving you only with risk, your financial decision would be just as easy as at the roulette wheel and all you needed to do was use the Kelly criterion with precision in setting your betting size. But you can’t, and this is why you need a margin of safety.