Investors in SINA Corp have been on a roller coaster ride for quite some time. For the last 8 months, that’s been including me.

SINA is a Chinese internet holding company and creator behind the massive micro-blogging social platform, Weibo (pronounced “way-bwo”—yes, that last syllable is a hard one). Weibo is commonly known for being the Chinese equivalent of Twitter, but really is more a combination of Twitter and Facebook.

While the social network is SINA’s largest revenue and income generator, they also own and operate several internet and mobile portals in the areas of news, finance, sports, auto information, and entertainment, as well as Fintech services and equity investments in other internet-related companies.

As seen on the all-time stock chart, SINA’s market value has experienced large volatility even for a Chinese internet company. While stressing, these large price swings have been warranted because the underlying business has experienced a volatile and uncertain path throughout the years as well.

The most recent race down the price scale started in February 2018, from a high of $117 per share to the current price of $38.80 which can essentially be explained by the following reasons:

- Slowing sales and earnings growth.

- A broader sell-off for the Chinese tech sector, primarily due to the trade war and China’s slowing economic growth.

- Moves by the Chinese government to regulate the social media space reinforcing the notion that there could be persistent and unpredictable roadblocks ahead.

- Fiercer competition from new social platforms and the increased dominance of the larger monolithic competitor, Tencent.

While agreeing with the market that there are significant uncertainties ahead for SINA’s future prospects in light of these factors, I do believe the current price level indicates a miscalculation of the risks inherent. So I started accumulating ownership in the SINA about 8 months ago when the stock price was in the mid-50s and have continually bought into the falling knife on its way down.

So you can probably guess that my investment in SINA significantly underperformed the market in 2019. While that’s always tough to face, especially in a rampant bull market, I have been quite satisfied with being able to continually buy into the company cheaper and cheaper without changing my assessment of the company’s intrinsic value. Such a commitment may be a deterrent to short-range performance, but it gives a strong promise of superior results over a several-year period combined with substantial defensive characteristics.

And now we just added SINA to the Junto investment portfolio.

Keep reading and I’ll tell you why.

The Story Behind SINA Since 1999

Now, before we can expect to derive anything meaningful out of looking at the numbers behind the company, it’s fitting to first go through the back story and why the stock has been on such a roller coaster ride.

SINA Corp was founded in 1998 in Beijing, China, through a merger of SRSNet, the then most visited internet portal site in China, and Sinanet, a website catered for the American Chinese community. Since then, the company has maintained a dominant position as the most visited internet portal site in China and was approved for listing on the Nasdaq exchange in April 2000. Like with the rest of internet stocks during that time, SINA received an exuberant billion-dollar valuation on slim revenue numbers and no profitability. They of course plummeted with the rest of the industry by the end of 2000.

In the following years, after shake-ups in the Board and management resulting from the internet bubble, SINA began to neatly bet heavily on value-added services in the mobile internet market by boosting its range of business through a string of acquisitions and at last turned a profit by 2003.

However, while initially doing well, that business segment suddenly started to experience fluctuation and disruption by 2005 which made the management work hard at diversifying its service proposition and finally launched Weibo in 2009. It was the breakthrough needed.

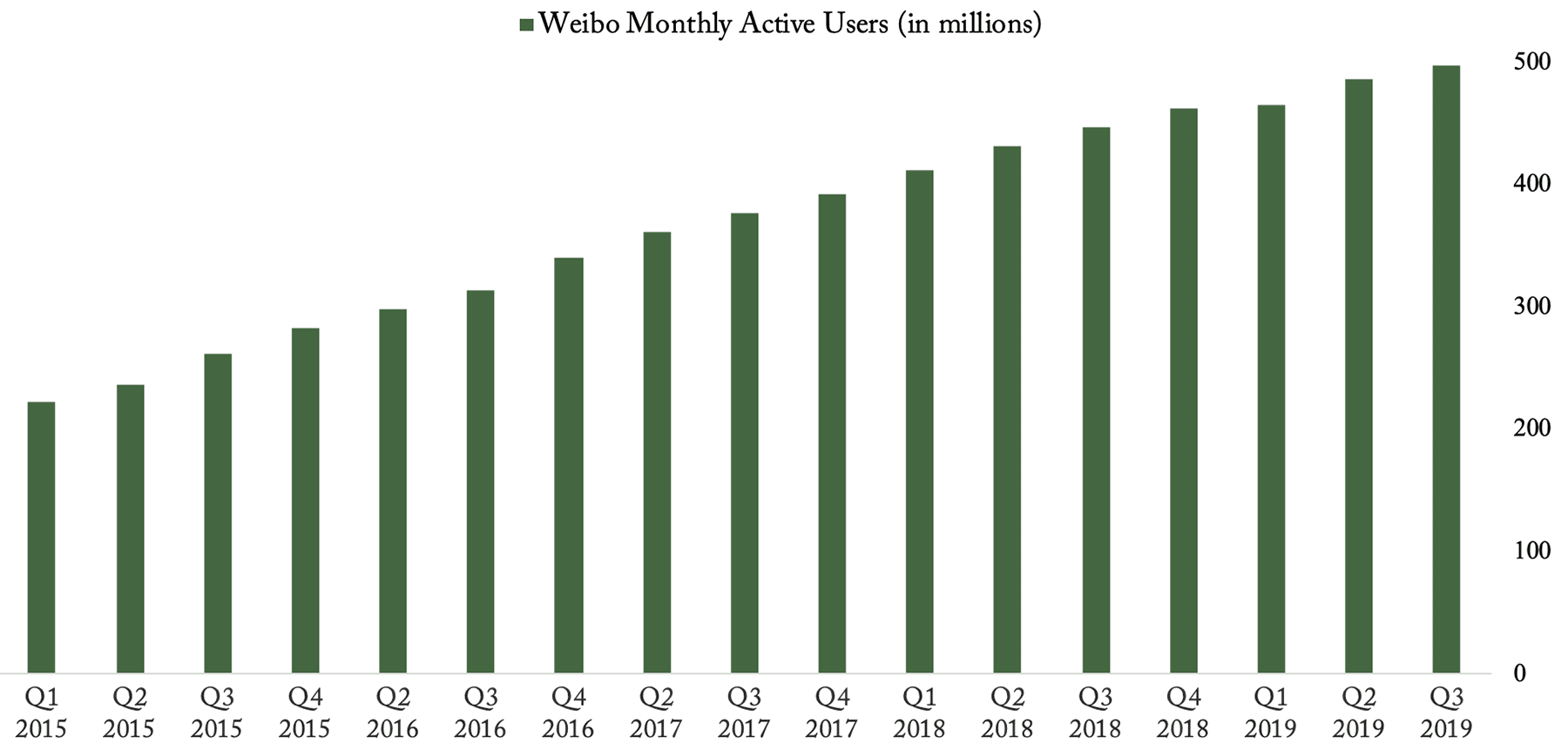

After starting to generate revenues in 2012, Weibo has since then experienced extremely rapid growth to 497 million monthly active users (MAU) and quickly replaced the company’s traditional portal advertising segment to become the largest revenue generator in 2015. The spun-off Weibo stock soared almost a thousand percent in a little over two years from 2016 to 2018 until hit hard by the market on uncertain growth prospects fueled by dim ad industry outlooks and economic/political instability. The price got pushed down almost 70% from its highs.

Then, as another attempt to diversify, Weibo recently released a new social and e-commerce app by the name of Oasis, comparable to Instagram, which after release quickly soared to the top 5 list of most downloaded apps in China. Its potential is yet to be uncovered.

As stated, Weibo is currently not fully owned by SINA. Back in March 2014, SINA announced a spinoff of Weibo as a separate entity and filed an IPO for the company while retaining 46% equity ownership (and 72% voting power). Alibaba bought in and currently owns 30.2%.

For a thorough walkthrough of Weibo, here’s a great guide.

In 2017, SINA also started offering online peer-to-peer loan facilitation and payment services which together became the company’s “Fintech” segment. Additionally, the company has generated sizable investment income over the years by investing early in other internet businesses such as Youku Tudou, the Chinese YouTube, and Alibaba, among others.

Conclusively, SINA’s business has transformed into what can now be divided into three segments: 1) its online portals, 2) its ownership stake of Weibo, and 3) its other businesses including Fintech and financial investments.

The segments by revenue for the past three years, as of the 2018 annual report, look as follows:

While SINA is effectively an internet conglomerate, it’s pretty clear that the company’s future prospects rely almost entirely on the prospects of Weibo while the company’s other segments are struggling to prosper. This has been evident in the large correlation between the share price action of SINA and Weibo. Charles Chao, the Chairman of the Board and CEO of SINA, is also the Chairman of the Board at Weibo which he has been since inception.

So if investing in SINA is effectively a more complicated vehicle to buy into Weibo with a few struggling business segments in the bag, why would an investor want to buy SINA over Weibo directly?

The answer lies in the valuation spread between the two companies. We’ll get back to this in the valuation section.

The Numbers Behind SINA

All charts and figures in this section have been structured and composed using the ROIQ model – a powerful tool to analyze and compare financial statements efficiently.

Because SINA has a controlling ownership stake in Weibo with its 72% voting power, it’s important to note that the following numbers and figures are on a consolidated basis. This means that SINA’s stake in Weibo is accounted for on a book basis rather than a market basis, and Weibo’s market value has slim to no effect on SINA’s consolidated income and balance sheet figures.

Let’s dive in.

SINA is dependent on the growth and profitability of Weibo.

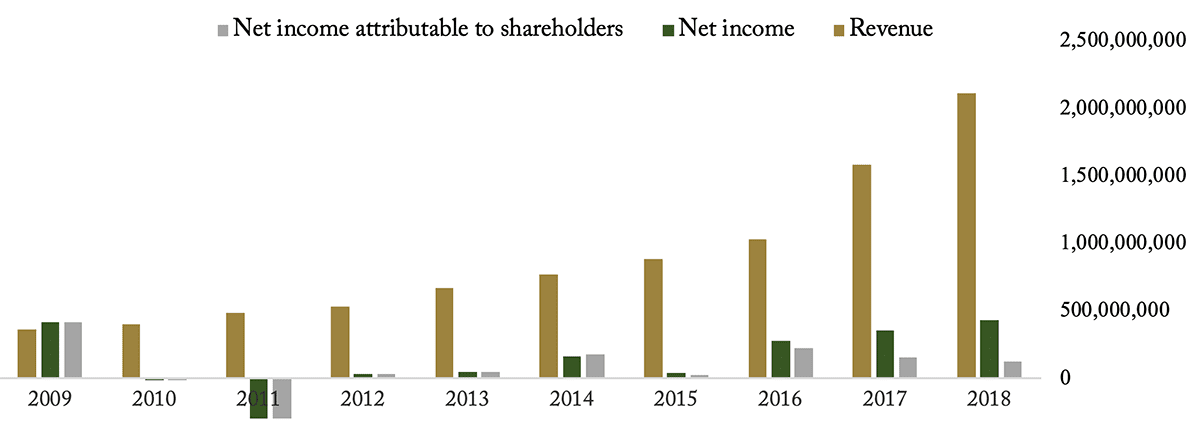

By the end of 2018, SINA’s consolidated revenue totaled $2.10 billion up from $1.58 billion in 2017, showing an impressive growth rate of 33% (but down from 57% the prior year). As stated in the previous section, this growth is entirely attributed to the immense growth in Weibo which has been the case since the social network started generating revenue in 2012.

Together with fast revenue growth, SINA’s operating and net income figures have ascended accordingly but are meanwhile dragged down by sub-par performance in the company’s other business segments.

The business possesses significant operating leverage.

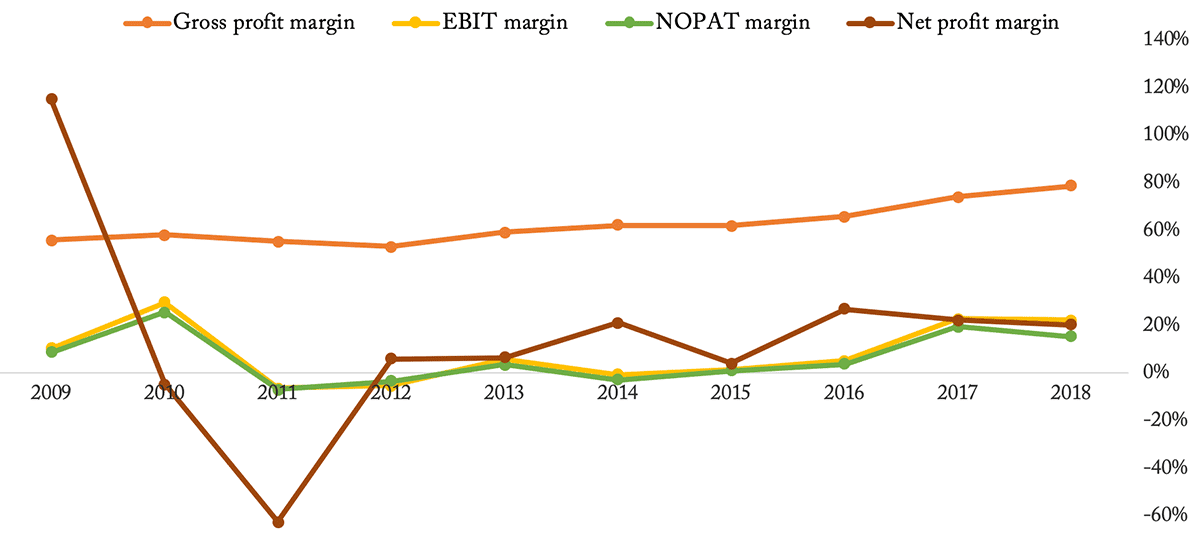

As shown below, SINA’s incremental revenue comes with very high margins. This leaves lots of cash left over to reinvest back into the business and into diversified investments to strengthen the company’s internet ecosystem.

As seen for the years 2012-2016, after-tax income has been consistently above net operating profit after tax. This has been due to large investment income originating from the realized gains in mainly Alibaba and Youku Tudou. Since we can’t expect investment returns of this size for the future, our focus will remain on operating income.

Due to shown operating leverage, SINA’s gross and operating profits have experienced higher growth rates than revenue since the network effects coming from a business model where about half a billion users provide free content for each other allow SINA/Weibo to serve each incremental ad at a very low marginal cost. SINA’s current gross margin of 79% (Weibo’s 84% gross margin is weighted down by SINA’s portal segment) is among the highest in the interactive media industry and leaves a lot of space for the company to develop new technologies (such as Oasis) as well as increase marketing spend needed to retain its competitive moat and grow the business.

And that they have.

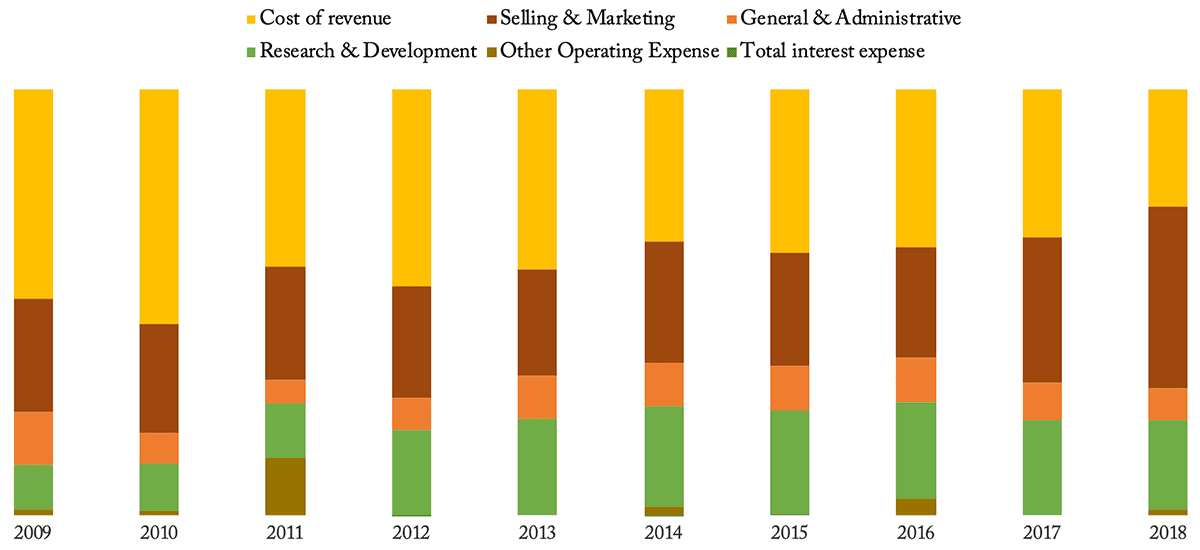

In 2018, SINA spent about $1 billion on marketing expenses and research and development. The last few years’ developments in the company’s cost composition have exemplified the necessity of increasing customer acquisition costs to keep up with competition and maintain a fast revenue growth rate.

But so far it hasn’t worked and they’re currently caught in a growth slump.

The problem is that these initiatives haven’t translated into growth throughout 2019, mainly due to a current slump in the digital ads industry. Like many other digital ad platforms in China, SINA/Weibo is struggling to sell ad space as the sluggish Chinese economy and uncertainties surrounding the trade war force companies to cut their marketing budgets. And competition from rival platforms like Tencent’s WeChat, Baidu, and ByteDance’s Toutiao as well as TikTok are only exacerbating the struggle.

These headwinds have caused SINA’s revenue growth to grind to a halt over the first three quarters of 2019 with revenue growing 8% YoY in Q1, -1% in Q2, and 1% in Q3 and why Weibo expects revenue to only rise 0%-3% annually in constant currency terms in Q4. This provides an indication that SINA’s revenue growth rate in aggregate will turn out neutral or negative in the coming 2019 earnings report.

Considering the fact that fast-growing internet companies are used to seeing a rather smooth year-on-year growth uptrend, no wonder why the market has punished the share price.

To counter that trend, Weibo has initiated attempts to diversify its core businesses away from digital ads by putting a bigger focus on value-added services, lately shown by the company’s acquisition of a live video streaming platform by the end of 2018. Weibo’s VAS revenue grew 39% in the fiscal year 2018 and currently accounts for 10% of the company’s total revenue. I believe there’s a lot of unexposed growth potential in this area as the company expands its e-commerce connection services in line with the new Oasis network and live-streaming platforms.

Is this a cyclical bottom?

The question we need answered is whether this current growth slump acts as a cyclical bottom or as part of a bigger decline in the Chinese online ad market, as well as how much room for growth there is left to derive from Weibo’s massive 497 million monthly users.

Observably, potential setbacks in the trade talks between the U.S. and China and a prolonged downtrend in the Chinese economy could still dampen hopes for stronger growth for the next couple of years and SINA could unreliably experience further years of struggle.

But despite industry-wide difficulties, I find great potential in current management to be able to capitalize on innovation in churning its current user base into a higher revenue level under the current leadership of Charles Chao at SINA and Gaofei Wang at Weibo.

Here’s why.

Considering that Weibo by the end of 2018 had 141 million more users than it Western peer, Twitter, but only managed to derive an average revenue per user of $3.7 compared to Twitter’s $9.5, there’s definitely room for improvement, notably in the high-growth VAS segment. Although Weibo is currently not in the limelight, I believe it remains a powerful tool for users and advertisers alike. Continued innovation will likely enable the network to stay on top of its micro-blogging niche and get better at grabbing low-hanging monetization fruits while the ad market recovers for Weibo to expand its growth potential.

Thus, I place a rather high probability on the scenario that Weibo will continue its high growth trajectory once the dark clouds clear. There’s no reason to believe that the Chinese digital ads market will not grow remarkably over time despite a few setbacks.

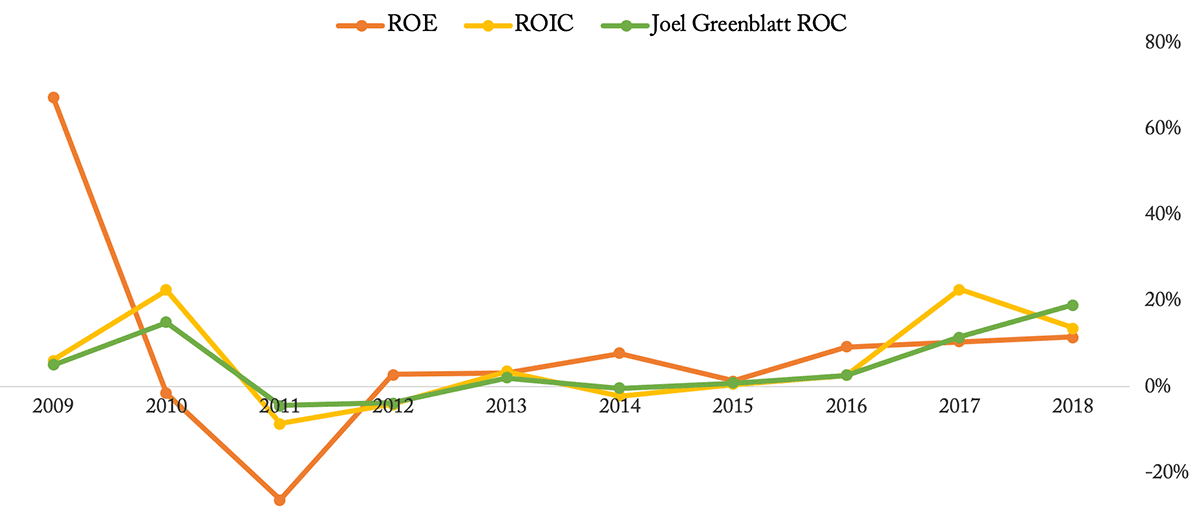

A large part of that appraisal lies with the ability of the current management “mix” of Charles Chao and Gaofei Wang. Have a look at SINA’s increased efficiency in allocating capital since Mr. Chao became Chairman of the Board and CEO at SINA in 2011 while Mr. Wang became CEO at Weibo in 2014. Return on invested capital excludes the company’s realized gains on financial investments.

***

Obviously, there are a lot of uncertain questions needed to come to light to assess SINA’s long-term outlook for an investor to determine the intrinsic value of the business. However, I think the key to analyzing SINA and Weibo is not to get precise with forward estimates, but to determine whether the company’s network will maintain its competitive position. Otherwise, placing growth assumptions matter little.

Let’s discuss this further.

Major factors governing the long-term outlook for SINA

While there are hundreds of factors that go into how SINA/Weibo’s market position will develop over the long term, there will always be a few variables and factors that carry the bulk of the weight. I believe there are two primary forces at play for the company’s prospects.

1. The Moat of Network Effects

Network effect moats exist when the value of a product or service increases for its users as more people use it. At times, the superior value received by users is in the form of a reduced economic impact, i.e., lower costs. We already established that this is the case with Weibo.

However, as an investor in future cash flows, determining whether people are still likely to continue using Weibo’s (and SINA portals’) properties is the most important variable to consider, since networks effects are arguably the deepest moat of early-mover social networks.

As seen below, the intense negative sentiment surrounding Weibo’s stalling revenue growth rate has yet to show any real erosion in the network’s ability to grow its user base each and every quarter.

Despite its already massive size and traction of a big part of the total Chinese internet population, Weibo added roughly 35 million users in the first 9 months of 2019 alone. There’s no question that user growth will eventually stall but as long as it remains intact and engaged, revenue growth will continue as digital ad spending eventually picks up again. The numbers above refer only to Weibo itself and don’t include SINA’s portal businesses nor the potential of Oasis.

While the network appears to be strong, it doesn’t fully define the strength of Weibo’s moat, though. This brings me to the other force at play.

2. The Microcosm of Chinese Society

Since Weibo’s main advantage is its pioneering and first-mover status in the industry, it has a well-established ecosystem and is deeply embedded in Chinese internet users’ habits while largely recognized in China.

Capitalizing on this position, Weibo early on successfully spotted three major trends in China: The Wanghong economy (meaning “internet famous”), live videos, and short videos. As a smart marketing move, Weibo made an annual festival out of the Wanghong trend which now attracts nearly all the most famous Chinese Internet influencers every year and is followed by millions of people. This has allowed Weibo to take a dominant position for companies wanting to advertise through key opinion leaders (KOLs).

But it’s not just Chinese celebrities and KOLs that largely depend on Weibo. It’s also been the main entry point for international influencers, such as NBA stars and Hollywood actors, to connect with their Chinese audience.

And while there’s a risk of competing Chinese social networks of capitalizing on the same strategy (which WeChat partly has), there are special features of Weibo that make the platform especially efficient for KOL marketing, among which are its integrations with the major Alibaba-owned e-commerce platforms, Taobao and Tmall.

I think this is a key factor that differentiates Weibo from the giant, WeChat. While WeChat is more focused on sharing communication among friends and social sub-communities, Weibo’s emphasis lies on an open, public nature with weaker strengths of relationship. Users on WeChat generally only subscribe to official accounts that push content they’re interested in. And while WeChat is a well-suited platform for sales conversion and customer services due to its large use of instant messaging, Weibo is better positioned for getting reach with a younger audience. The fact that their services cater to two different user purposes in the same market partly limits the threat to Weibo’s competitive position.

Meanwhile, because social media services such as Facebook, Twitter, Instagram, and Snapchat are inaccessible in China, it’s evident that Chinese social networks operate as an entire ecosystem with very different kinds of competitive dynamics than with Western social networks and online platforms. Chinese online businesses possess a clear cultural advantage with access to the largest online community in the world, locked off for international competitors. It’s undeniable that regulations have made it much easier for Weibo and its Chinese peers.

On the contrary, that cultural advantage, unfortunately, involves dealing with China’s often peculiar regulations in terms of information censorship. China manages social media via a broad range of regulations through multiple governmental entities applying advanced filtering technologies to snatch up content that may rock the socialist regime.

To comply with these extensive laws and guidelines pertaining to content control, internet companies in China have and will continue to incur significant costs in terms of manpower and technology to filter information. Weibo and other Chinese social peers have been caught under the rug by governmental crackdowns a few times in its history for “spreading harmful content”.

This also means that as Chinese internet networks grow larger at home and abroad, their compliance with China’s domestic regulations and reputation for doing so sometimes comes at the cost of expansion. WeChat, has experienced several backlashes in its global expansion plans because of imposing censorship on international users ‘by accident’. Instances such as these continue to hamper users’ confidence in WeChat and remind international users of the restrictions that Chinese applications face at home.

Apparently, limited competition is not entirely free in China (shocker).

Valuing SINA Corp

We’ve talked a lot about earnings and growth in this analysis which is typical when analyzing growing internet businesses. So that’s why you will probably be surprised that my assessment of SINA’s investment value is essentially coming more from an asset base than an earnings base.

Honestly, my assessment of SINA’s earnings prospects is just as uncertain as everyone else’s. I don’t have any informational edge on the company’s business (not just because I’m not based in China) and I have no idea how the Chinese ad market, the trade war, nor the Chinese economy is going to behave in the short-term. What I do believe to possess is a time-horizon edge with a willingness to thoughtfully analyze what most people want to avoid out of fear of what the next year might look like.

As John Huber at Saber Capital Management says:

Football fans, media members, and stock market participants all tend to overemphasize the relevance of recent events and get overly influenced by negative sentiment, and this causes inaccurate assumptions and extrapolations, both in football and in stocks. In the market, this is how stocks get mispriced.

In my last article on Mohnish Pabrai’s book, The Dhandho Investor, I talked about how value investors should look for high-uncertainty, low-risk situations. Due to SINA’s current pricing and uncertainties of what lies ahead, I believe this is such a scenario.

At the current market cap of $2.70 billion, we are paying 14.40 times forward earnings excluding net cash and marketable securities of $900 million and amazingly 0.98 times the book value. At this price, the market basically assumes that management will generate subpar returns on invested capital going forward, directly contrary to the trend delivered over the last five years. This is quite atypical with capital-light, profitable businesses.

Let’s dive further into the balance sheet.

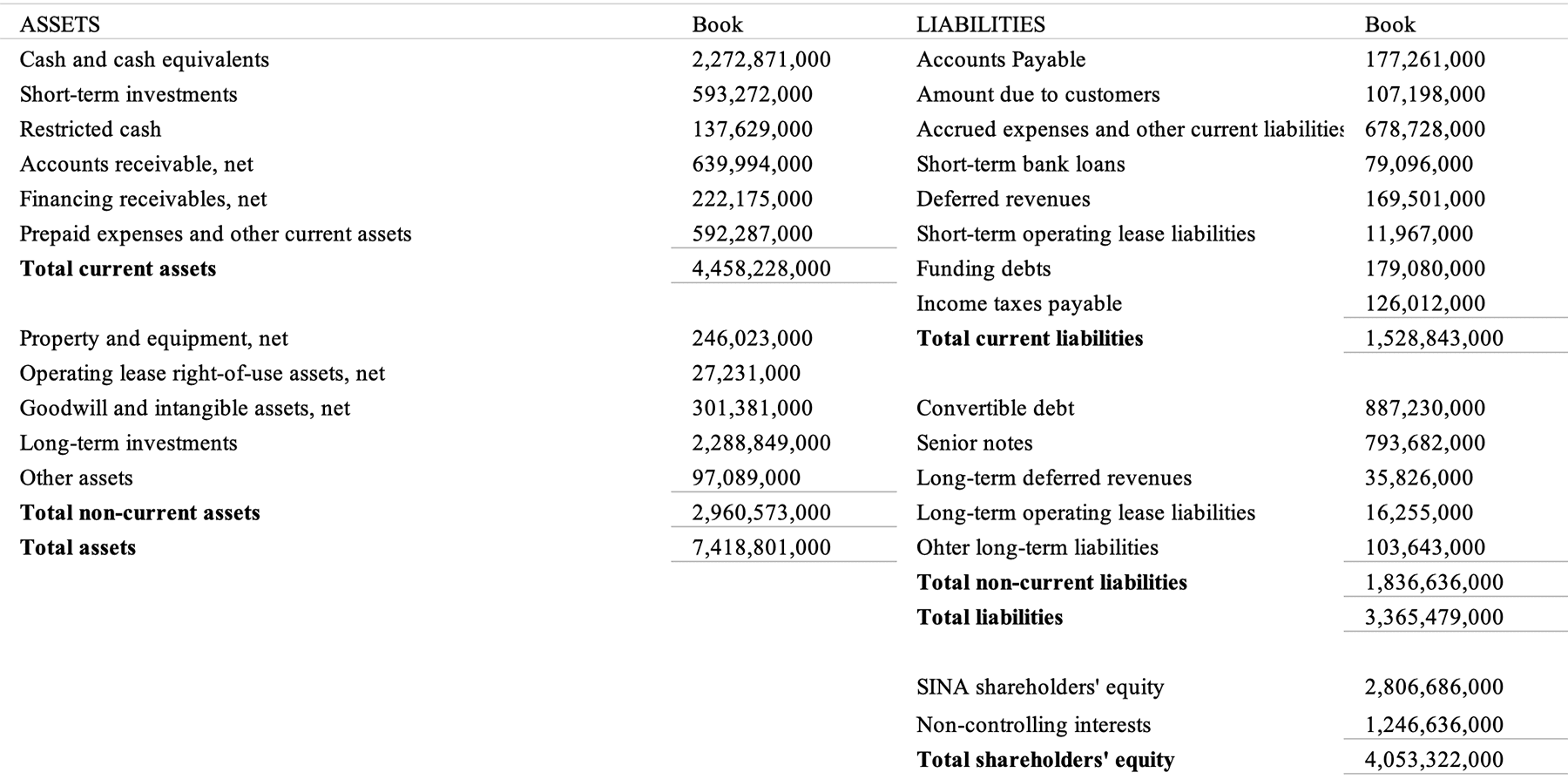

By the end of the third quarter of 2019 SINA’s assets and liabilities looked as follows:

As evident, SINA’s assets consist largely of liquid assets and investments with very little capital locked up in fixed assets and intangibles. Meanwhile, a large part of the company’s liabilities is related to deferred payments while the company already accounts for capitalization of operating lease obligations. Assuming that management has not been making bonehead decisions with its large financial investments, it’s a healthy balance sheet.

Now, assuming the scenario where management is not able to derive effective utilization of this capital, what would be an appropriate value of the balance sheet figures if assets where sold off in a prompt sale and total liabilities settled?

At SINA’s current market cap, we buy into the company at a price of which my estimate of liquidation value makes up 63%.

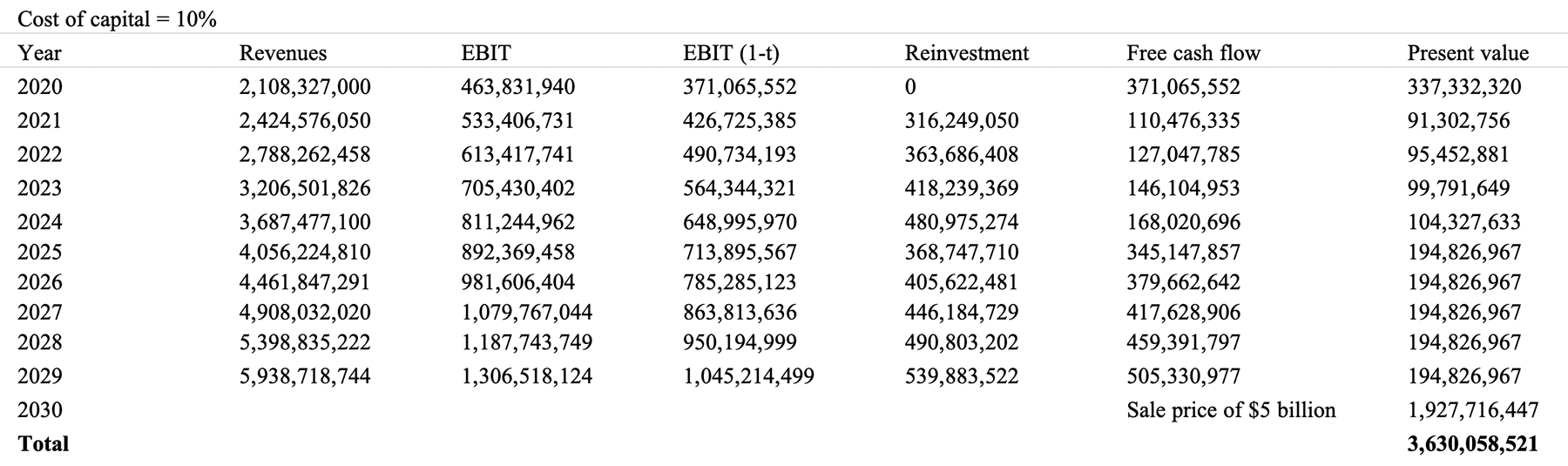

Now, let’s do a conservative estimate of SINA’s going concern value using discounted cash flows.

In light of what we’ve learned, I make the following assumptions about SINA’s future cash flows:

- Operating margin will remain steady at the current 22%.

- Effective tax rate will increase to a steady 20%.

- Sales to capital ratio will stay at 1 reflecting the industry average and a slight adjustment of SINA’s large cash balance. The five-year average sales to capital of SINA has been 0.80.

- Revenue will not grow for the next year (from the fiscal year 2019 in which we expect no growth as well) and will then increase to 15% for the next four years, then 10% a year thereafter.

- The business is sold after year 10 for 10 times the prior year’s free cash flow to reflect the generally lower-than-global multiple of Chinese equities.

We can thus derive the following cash flow table:

By adding excess net cash and subtracting non-controlling interests we arrive at an equity value of about $3.5 billion, or $51 per share.

Lastly, let’s compare the current market pricings of SINA and Weibo.

Weibo is currently trading at a market cap of $9.71 billion which makes SINA’s 46% equity stake (with 72% voting power) worth at least $4.47 billion at current prices. By valuing SINA on this measure alone including SINA’s net cash over Weibo’s of $220 million, it would put SINA’s value north of $65 per share. This discount in pricing probably reflects a large conglomerate discount and the fact that the market thinks SINA’s other business segments and financial investments will destroy value over time. I think that assumption is too strenuous, and thus SINA is the cheaper vehicle to invest in, looking significantly undervalued.

***

It’s very difficult to judge a range of probabilities of where SINA’s value is likely to end up but I think we can safely make the conservative conclusion of determining SINA’s intrinsic value somewhere between $50 and $65 per share. Hence, I feel fairly comfortable that we’re buying at the lower end of the spectrum. Because the company’s current market value is priced so close to asset value, we only needed to make moderate assumptions about future growth in order to classify SINA as a value investment.

And as long as management will continue to earn high returns on capital while delivering potential growth when the dark clouds clear, I see no reason why that intrinsic value shouldn’t grow over time.

I’m happy to become an owner of one of China’s strongest digital brands and social networks at what I perceive to be an attractive price for a long-term position.

Ending Remarks

Remember how this write-up started by pointing out how SINA investors have been on a roller coaster ride? This ending quote might be perceived as easily misinterpreted, but I frankly found it amusing and ironically fitting:

”The only ones to get hurt on a roller coaster are the jumpers.”

– Paul Harvey

I think SINA’s stock price will continue to be a volatile experience for investors in either direction. That’s nothing new for neither SINA nor any Chinese internet stock. But our primary attention is given at all times to the underlying business.

I don’t have the faintest idea where SINA’s stock price will be even within the next 2-3 years but I feel fairly confident that we buy into the business at an attractive price for the long term. We aim to have our purchase prices be so attractive that even a mediocre sale gives good results if taking advantage of the time-horizon edge.

And as for where the general market is heading for the next couple of years: I don’t have the faintest idea either. Though I wouldn’t mind a marketplace of where to find more attractively priced businesses than currently available.

As Ben Graham famously said:

“If you are shopping for common stocks, choose them the way you would buy groceries, not the way you would buy perfume.”

– Benjamin Graham

At the moment, it does feel like the market is one giant Bloomingdale’s. It’s getting tougher but we’ll continue flipping stones.